One of the many tools in the Internal Revenue Service's audit box is a mountain of data, including all of the deductions taken by all of the taxpayers in the U.S.

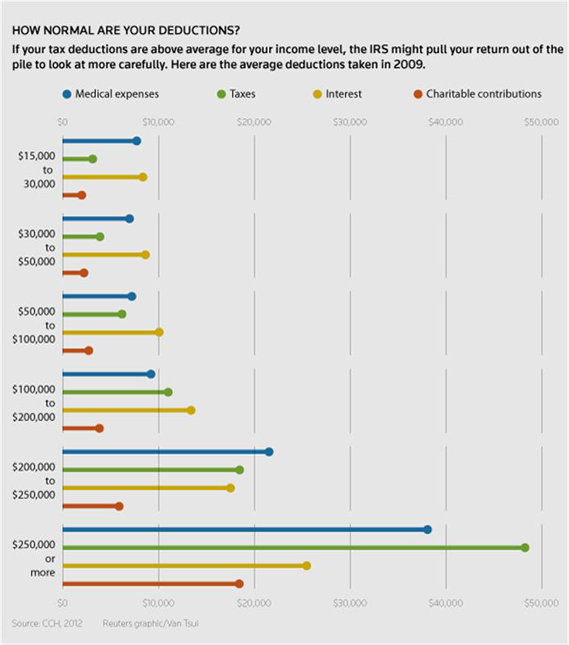

Agency computers determine average deductions for different categories and income levels, and use that information to find outliers. For example, taxpayers who declared between $50,000 and $100,000 of income in 2009, claimed, on average, $7,269 for medical expenses, $6,247 for taxes, $10,133 for interest and $2,775 for charitable contributions, according to CCH, a tax research company.

If your deductions are way out of line for what's typical at your income level, that doesn't mean that you've done anything wrong or even that you will be audited. It's just one indication that your return might get pulled out of the pile for a closer look.

This graphic shows average deductions claimed by taxpayers in different income levels.

(Reporting by Linda Stern)