The Great Recession hit everyone, but it didn’t hit everyone equally. A report released Wednesday by the Urban Institute found that the Great Recession’s impact on employment varied greatly by metropolitan area. Some metro areas that withstood the initial recession are have lost ground while others that were devastated in 2008 and 2009 are now rebounding.

RELATED: The Top 10 Cities People Are Moving To

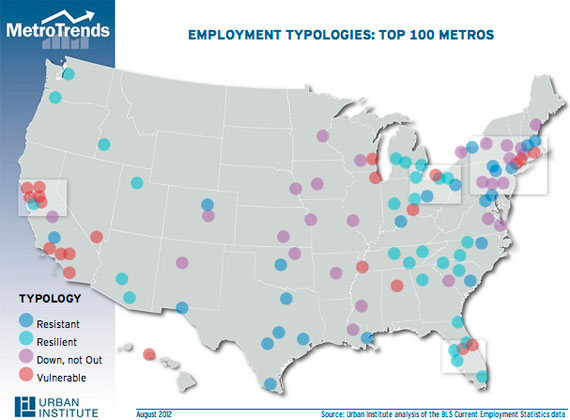

The study found that the country’s 100 largest urban centers saw employment drop by a median rate of 5 percent during the recession. Since then, they’ve seen a tepid median rebound of 1 percent. Based on the individual employment trends for each area, the Urban Institute researchers placed the cities into one of four categories: Resistant (good recession and solid recovery), Resilient (bad recession and solid recovery), Down, Not Out (good recession but bad recovery), and Vulnerable (bad recession, compounded by bad recovery).

For an interactive version of the map, visit MetroTrends .

The Northeast and the South have proven most resistant to the effects of the recession. Boston, for example, saw a 3.8 percent decline in employment during the recession and a 1.7 percent gain afterward. Pittsburgh, meanwhile, experienced a drop of 2.2 percent and has gained back 2.2 percent since mid-2009. Every metro area in Texas did relatively well both during and after the downturn.

On the other end of the spectrum, California metro areas collectively suffered the most. Nine areas in that state endured the double-whammy of a bad recession followed by a nonexistent recovery. In the Sacramento area, for example, employment fell 7.7 percent during the recession, and has dropped another 3.9 percent since then. Across the entire state, only San Jose – buoyed by Silicon Valley – and Bakersfield, a diverse oil-producing economy, have come out relatively unscathed.

One surprise in the report may be Florida. After being pummeled by the housing crisis, five out of the seven major metro areas in the Sunshine State have proven “resilient,” meaning they returned to significant employment growth.

The Recovery by Industry

Some industries – like health care and education – can usually prosper even in bad times. Areas that rely heavily on those industries tended to weather the recession fairly well. They may not be experiencing a pop now, but they don’t have much of a hole to dig themselves out of, either. And while state governments have made dramatic cuts in the wake of the recession, Washington D.C., where employment is dominated by the federal government, hasn’t suffered nearly as much: Employment fell there only 2.3 percent during the recession, and has risen 1.8 percent since then.

On the other hand, local economies that were based on retail trade, leisure and hospitality, transportation and utilities – all sectors that tend to get cut out of household budgets first when times get tough – have not fared well. Las Vegas, which was hit hard by the housing crisis and relies heavily on leisure and hospitality, suffered an 11.1 percent drop in employment during the recession, and a further 1.5 percent drop after it.

What Next?

The report makes two principle recommendations based on its findings. One, economic recovery measures could be better tailored to individual city’s needs, for example by supplying stimulus to a specific industry common to the hardest hit areas. And two, cities should strive to insulate themselves from future economic crises with an approach often taken by individual investors: diversification. In other words, cities looking to avoid deep downturns must broaden their industrial mix, ideally with growth in sectors that are known for their resilience in the face of recessions.