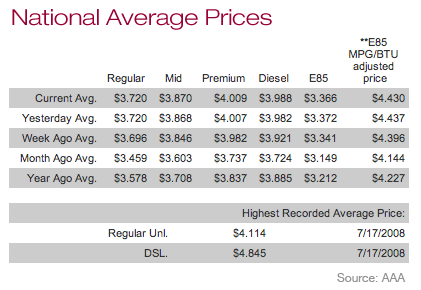

Gasoline prices have shot up to $3.72 a gallon – ashocking 26-cent leap in the last month that reportedly has a politically vulnerable President Obama searching for ways to lower fuel costs.

Consumers usually respond to pain at the pump by cutting back their spending elsewhere, likely dragging down what has been a sluggish recovery just ahead of the November election. And higher prices give Republican presidential contender Mitt Romney an easy target for attacking Obama – one used when gas spiked this spring that can easily be repeated at the GOP convention next week.

The administration floated the possibility late last Thursday of releasing supplies from the government’s Strategic Petroleum Reserve. Commodity traders were mostly unimpressed, as oil futures dipped slightly on Monday to $90.91 a barrel.

“The dominant theory is that prices are high and those in political power have to be perceived as doing something to address that,” said Tom Kloza, chief analyst for the Oil Price Information Service. “The other theory is a little scarier. Perhaps they’re getting ready for the structure by which they would release oil if something happens between Iran and Israel in the Middle East.”

But the United States might be forced to tap its reserve without much international support, after Maria van der Hoeven, executive director of the International Energy Agency, told Reuters, "There is no reason for a release.” Members of the G-8 notified the IEA in May they were prepared to tap their reserves, but anxiety over a showdown between Israel and a nuclear-ambitious Iran began to ease and so did prices.

The latest data suggests a humdrum rationale for the rising gas costs: demand usually peaks during summer vacation season.

U.S. stockpiles have dropped to their lowest level in four months, while daily usage of oil has jumped by 7.7 percent over the last month, the Department of Energy said last week. All of that has occurred amid an increase in domestic oil production and a multi-year decrease in demand. But there’s been the logistical hurdle of getting domestic oil drilled from the heartland out to coastal refineries, in addition to a fire at a Chevron refinery in California and a dozen smaller issues that have recently driven up futures prices.

The drought rampaging across the Midwest – destroying cornfields – has yet to make much of an impact, since ethanol continues to be cheaper than the gasoline it gets mixed with.

“This is much ado about normal,” Kloza said. “It is not the beginning of the march to $4, $4.50, $5 a gallon, and some of the nonsense that’s out there.”

If the normal seasonal pattern holds, gas prices should tumble after Labor Day. But that’s an “if” with several asterisks.

Another disaster – more refinery outages, hurricanes in the Gulf of Mexico, tensions escalating with Iran to a point that halts oil production – would be the wildcard for one of the election’s major pocketbook issues.

“Cross your fingers,” Kloza said of those possible threats to oil prices.

And gas prices will play differently across the country, since states such as California and New York that are expected to be easy wins for Obama are among the places where costs consistently remain the highest. Gas in the swing states of Florida and Virginia has crept upward over the last month to plateau just below the national average, while Ohio jaggedly peaked around $3.87 a gallon at the start of the August and then rolled down to $3.72, according to GasBuddy.com

When gas last approached these levels, Romney demanded Obama fire three of his cabinet members—Energy Secretary Stephen Chu, Interior Secretary Ken Salazar, and EPA administrator Lisa Jackson – and lift restrictions to reduce drilling offshore and on public land.

The former Massachusetts governor also posted a video online that attacked the president for "spending millions to sling mud – or oil – at Mitt Romney. Why? Because in the five states where Obama's attacking Romney, gas prices have roughly doubled. But Obama's mud can't cover up his failed energy policies.”

Gas reached a high this year of $3.94 a gallon in April, about 17 cents shy of the all-time record set in July, 2008.

That increase largely occurred as refiners switched to a summer gasoline blend – briefly pinching supplies – and hostilities with Iran risked choking off shipments from the Middle East. Obama responded by resurrecting a dormant task force looking at futures market manipulation, in addition to calling to end tax breaks for oil producers.

“Anyone who tells us we can drill our way out of this problem doesn’t know what they’re talking about, or isn’t telling you the truth,” he said during a March speech in New Hampshire. Public pressure faded on gas prices as prices plunged back toward the $3.40 range.

But the real blow to Obama and the economy could be more indirect. When Americans fork over more money for gasoline, they have less for other purchases – food, clothing, gadgets, entertainment – and the economy growing at a 1.75 percent pace this year slows down and wheezes a bit more heavily.

“The gasoline price rise has not been enough to push the economy into a recession,” Scott Brown, chief economist for Raymond James & Associates, wrote in a Monday client note, “but it’s not going to help.”