·Credit conditions are consistent with 180,000 new jobs per month in 2011. |

Modern economies run on credit. Take it away and activity collapses, as in the 2007-09 recession. The trigger was massive loan losses that forced banks to tighten their lending standards more than any time since the 1930s. The result was sharply fewer loans that knocked the breath out of the economy, pushing up unemployment, creating more defaults and even less willingness to lend. This vicious cycle between the flow of credit and economic activity accelerated the economy’s downturn.

Fast forward to 2011. “This damaging dynamic—the adverse feedback loop—now appears to be reversing,” New York Federal Reserve Bank President Bill Dudley said at a press briefing last Monday. Translating Dudley’s econo-jargon, the credit spigot is opening again, and the cycle between financial flows and economic growth has turned from vicious to virtuous. Recent data and surveys show credit conditions in the banking sector are improving rapidly. Banks are more aggressively seeking out borrowers, even as more businesses and consumers are looking for loans. This means the recovery is starting to get the financial fuel it needs to be strong and self-sustaining.

More banks eased their lending standards than tightened them throughout 2010, according to the Federal Reserve’s quarterly survey of loan officers, but loan volumes continued to fall because businesses were too worried about the future to commit to more debt. At the same time, households were more interested in getting rid of debt, not taking on more. What was new about this year’s first-quarter survey was that banks, while still reporting they are easing their terms and conditions, are now starting to see stronger loan demand from both households and businesses.

Households are responding to banks’ less stringent standards. They increased their non-mortgage debt in the fourth quarter for the first time in two years, according to the New York Fed’s latest Household Debt and Credit Report, released on Feb. 14. Key signs of stronger credit demand included an increase in the number of credit card applications and an uptick in the number of open card accounts. Plus, revolving credit in December posted the first increase since August 2008.While household debt adjustments are far from complete, the New York Fed’s Dudley said the report’s findings are encouraging, “because households’ renewed demand for credit has no doubt supported some of the recent rise in consumer spending.”

Business borrowing is also picking up. That’s important to the virtuous cycle because credit flows to companies and job growth have always been tightly correlated. An analysis by economists at UBS shows that the steep decline in payrolls during the recession closely tracked the exceptional tightening of lending standards. They also say easier lending conditions over the past year are consistent with their forecast of job growth averaging 180,000 jobs per month during 2011, which would be a near doubling of 95,000 per month in 2010. More jobs will, in turn, enhance loan quality, feeding more loan demand and more spending.

Last year, banks’ terms and conditions for business loans returned to about where they were in 2006, Fed data show, but only now is lending volume starting to pick up in any meaningful way. In the three months through January, commercial and industrial (C&I) loans by large U.S. banks increased by $10.4 billion, while loans by small banks rose by $2.2 billion. Both three-month increases were the largest in more than three years, a period during which the volume of C&I loans plunged by some $350 billion.

An analysis by economists at J.P. Morgan Chase shows that the mix of lending standards and loan demand indicated by the Fed’s surveys usually foreshadows the growth of C&I loans about three or four quarters into the future. The last time the mix of survey results and loan volumes were at their current positions was in mid-2003, they say, the start of eight quarters of GDP growth averaging nearly 4 percent.

The rise in C&I loans by small banks is especially important, given that small businesses depend largely on small local banks for credit, and small companies make up about half of all U.S. payrolls. A survey of small business credit trends through October of last year, published by the National Federation of Independent Business (NFIB) on Feb. 2, showed that more than half the firms didn’t need any new loans. That was then. The Fed’s first-quarter survey of bank lending showed that demand for C&I loans by small firms, while hardly robust, had risen to the strongest level in five years. And banks appear more willing to lend: A January reading by the NFIB showed that only 10 percent of companies said credit was harder to get, the lowest since October 2008.

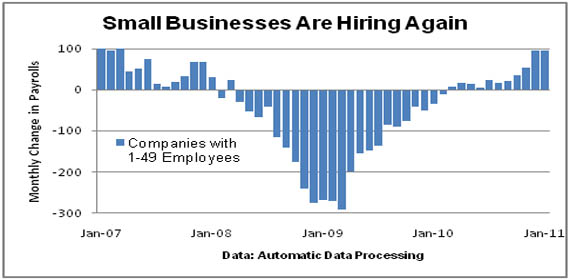

Not surprisingly, credit conditions and small business hiring are moving in lock step. Companies that employee 1 to 49 workers accounted for nearly half the rise in private-sector payrolls over the past six months, according to Automatic Data Processing. The monthly gains have been increasing steadily, with back-to-back increases of nearly 100,000 jobs in December and January. That tracks well with the NFIB’s monthly index of small business optimism, which in January rose to the highest level since December 2007.

One reason bank lending is picking up is increased competition. Of 30 banks that eased their terms this quarter, 28 cited more aggressive competition from other banks as an important reason. One result: About half said they had sliced the spread between loan rates to customers and their cost of funds.

Increased competition is a sign that vitality is returning to the banking sector and that the credit spigot is opening up. It is also an indication of growing synergy between financial flows and economic activity. Of the banks that eased their lending standards this quarter, 73 percent cited a more favorable or less uncertain economic outlook as a key reason for doing so, up sharply from 59 percent in the fourth quarter. This virtuous cycle will keep on spinning in 2011, as expanding credit and a growing economy continue to build on each other.

Related Links:

Small Business Lending is a Good News-Bad News Story (Tampa Bay Business Journal)

A Warming Trend in Credit (CFO.com)

Companies’ Jobs Outlook Rises to Decade High (Bloomberg)