|

Consumers are struggling. Despite the pickup in job growth in recent months and the big 2 percent cut in payroll taxes starting in January, their inflation-adjusted spending in the first quarter appears to have grown at only about half the fourth quarter’s 4 percent clip. The reason: Higher costs for energy and food, which make up nearly a fourth of household budgets, are cutting deeply into consumers’ buying power. Household incomes already face significant headwinds, and this new challenge raises one more question about consumers’ ability to power a strong and durable recovery.

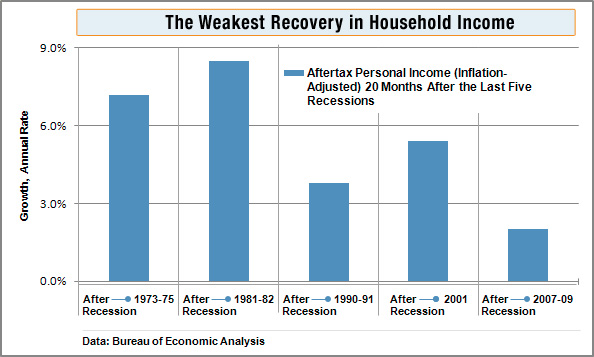

Poor income growth has been the biggest constraint on consumer spending throughout this recovery, which will be two years old in June. That’s especially true as households face the dual pressures to pay off past debt and to save more to make up for lost wealth. Since the recession ended, inflation-adjusted after-tax income has grown at only a 2 percent annual rate, the slowest pace in any of the past five recoveries.

With consumers accounting for 70 percent of GDP, the economy is estimated to have slowed last quarter from the fourth quarter’s 3.1 percent pace, instead of speeding up as had been widely expected. The Commerce Dept. will report first-quarter growth on April 28, but economists say the pace of GDP appears to be tracking a gain of about 2-to-2.5 percent. That’s no disaster, but it’s not fast enough to maintain the recent improved pace of job gains that will be increasingly important to income growth later this year. It also highlights the recovery’s vulnerability to unforeseen shocks.

Ironically, income was not the problem in the quarter ended March 31. After-tax income appears to have grown about 6 percent, based on monthly data. Changes that accompanied last year’s tax deal boosted income growth by about 2 percentage points, a fillip mainly reflecting the payroll tax cut. The other 4 percent was all eaten up by inflation. For the latest quarter, grocery store inflation has been running at a 7.2 percent annual rate, with fuel oil close to 70 percent and gasoline at 79 percent if prices continue to rise at the same pace as in the last three months. Overall, inflation-adjusted income after taxes rose only about 2 percent.

Under current conditions, even 300,000 jobs per month

would lift wage and salary income by only about one

percentage point.

Even if energy and food inflation subsides in the second quarter, as the Federal Reserve and many private-sector economists anticipate, incomes may not do any better. Economists at J.P. Morgan point out that, while the lower payroll tax applies for the full year, its boost to income growth affects only the first quarter, when taxes shifted down to their new lower level. Thus, the two percentage point upgrade to income growth goes away. That leaves labor markets, where the economists estimate that gains in jobs and wages should lift income by about 4 percent this quarter. The bottom line: Even if overall inflation falls back to half of its first-quarter rate of about 4 percent, inflation-adjusted income will once again grow by only about 2 percent.

The chief problem is that increases in basic labor income from wage and salaries, which are the most sensitive to economic growth and account for about 60 percent of overall household income, are being held back by weak growth in hourly pay. Although monthly increases in private sector jobs averaged 188,000 last quarter, average hourly earnings are going nowhere. Hourly pay growth has been stuck at about 1.7-to-1.8 percent per year since early 2010. Before the recession, job growth was similar to what it is now, but hourly pay was growing twice as fast, a combination that generated much more wage-and-salary income.

Hourly pay is unlikely to pick up significantly until the unemployment rate falls much further. With joblessness at a still-high 8.8 percent in March, there are still plenty of people willing to accept little or no wage increases as long as they have a job. Even with solid payroll gains of 200,000 per month, hourly pay growth of only 1.7 percent will generate only about 4 percent growth in income from wages and salaries — before inflation. In the first quarter, that pace was too slow to keep up with surging prices. Under current conditions, even 300,000 jobs per month would lift wage and salary income by only about one percentage point.

So far, consumers are bearing up. Big retailers reported March receipts that were better than feared but hardly strong, and households continue to plunk down money for big-ticket durable goods, such as cars and appliances. That’s important, say economists at Barclays Capital, because those items are consumers’ most discretionary purchases and the ones that tend to fall off first when spending starts to deteriorate in a sustained way. So far, they say, outlays for durables have continued to rise at a double-digit rate. “We do not interpret the January-February softness as evidence that the trend in consumer spending is rolling over,” says Barclays economist Dean Maki.

Still, just how much oomph consumers can offer the economy this year remains an open question. Even if inflation settles down after its first-quarter spike, the return to a more normal pattern of government income support and household tax payments will weigh heavily on consumer incomes. J.P. Morgan economist Michael Feroli calculates that in the past two years the household sector has received more in direct cash payments from the government — including unemployment benefits, Medicare, Social Security, education assistance, veterans benefits and other things — than it has paid in taxes. “If this net flow even partly returns to normal,” he says, “it would represent a significant drag on incomes.”

In coming months, the task of generating enough income to support consumer spending will fall increasingly to the labor markets. The problem is that, despite the improved pace of job growth, it will be a long time before the economy can take up the large amount of slack in the job market. Until then, basic income growth from wages and salaries will remain less than robust.