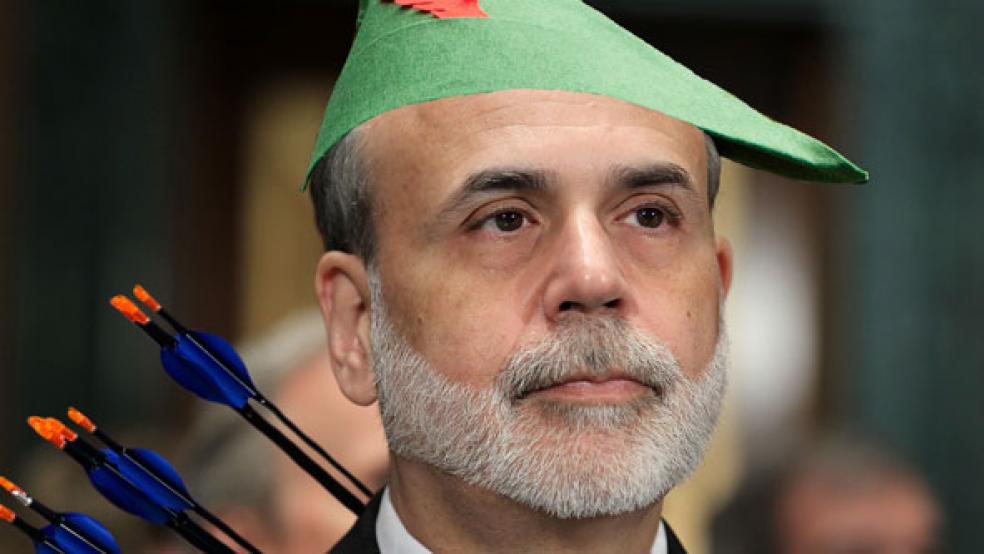

If you’re wondering why the rich are getting richer, ask Mr. Bernanke.

President Obama has accused Mitt Romney of being a “reverse Robin Hood” – taking from the poor and giving to the rich. Ironically, that’s exactly what Fed Chair Ben Bernanke is doing, with the blessing of the Obama White House. Mr. Bernanke has again opened the central bank spigots, promising another round of quantitative easing, or bond and asset purchases, aimed at keeping interest rates low for the foreseeable future.

The upshot? Rising gasoline prices which will hurt low-income Americans, reduced income for retirees, and soaring stock prices. While seniors worried how they could cope with diminished incomes, the 40 wealthiest people in the world saw their net worth jump by $29 billion this past week.

This is not a fantasy. In his press conference following the policy announcement, Mr. Bernanke agreed that his plan would “affect stock prices.” He was right. Since the first quantitative easing was initiated in 2008, stock prices have soared over 60 percent. More recently, on the day the Fed announced its new, open-ended purchase program, the Dow Jones gained 1.5 percent; more important, both the Dow and the Standard & Poor’s index hit their highest levels since the end of 2007.

Why this exuberance? Because traders understand that flooding our monetary system with hundreds of billions of new dollars will crush yields, leading return-hungry investors into higher-risk investments like stocks. The joy was not limited to our shores; stocks in Asia and Europe celebrated as well.

It is the Fed pushing stocks higher, not fundamentals. Share prices have surged even though the outlook for corporate profits – the basis for share prices -- has dimmed. Thomson Reuters reported last month that Wall Street analysts have been cutting forecasts and are predicting that “S&P earnings will post a decline in the third quarter, for the first time since the third quarter of 2009.”

A more recent Thomson Reuters report predicts that companies will “post the slowest annual revenue growth in the past decade.” FedEx, Intel and Burberry are among the companies recently warning of a possible earnings stumble. Normally, such a deteriorating outlook would drive share prices lower. But not with Mr. Bernanke at the helm.

Stocks were not the only beneficiaries of the QE3 announcement. Gold shot up 2.2 percent and oil prices crested at $100 per barrel for the first time since May. The Wall Street Journal reported last Saturday that for the month, oil prices are up 2.6 percent, “largely on expectations that the Fed would act.” The boom in commodities reflected not only the same yield-seeking pressure that fueled higher stock prices, but also the inevitable weakening of the U.S. dollar.

The dollar has been under pressure for weeks in anticipation of the Fed’s move. After rising steadily since the end of May, the Dow Jones FXCM Dollar Index has fallen more than 5 percent over the past month as traders placed their bets on another round of easing. While that weakness could help spur exports, other countries are unlikely to take that challenge lying down. Some, like Japan, may well intervene to counter any advantage given the U.S. by a weaker currency.

Meanwhile, real people reacted to the Fed’s announcement last week with added anxiety about nascent inflation after a report that August wholesale prices posted their biggest jump in three years. The producer price index rose 1.7 percent, exceeding expectations. Core prices, not including food and energy, advanced a slim 0.25 percent. The follow-up consumer report showed that prices people pay for everyday goods rose 0.6 percent last month – also the most in over three years. Food prices climbed 0.9 percent - the most since November. Again, stripping out food and energy, the needle barely budged. Who cares? Most people have to eat, drive to work and heat their homes.

So how exactly do we expect to benefit from the Fed’s move? Boosters claim that rising stock prices will instill confidence, which will jack up spending. That’s rich, because arguments that President Obama’s regulatory tornado and promises of higher taxes might have the opposite effect have been derided by liberal economists like Paul Krugman, who summarily dismiss the “confidence fairy.”

Who is expected to gain confidence from rising share prices? Presumably the dreaded one-percenters -- the most likely group to personally own stocks. Or maybe we should expand that to the ten-percenters, who, according to the Economic Policy Institute, own 81 percent of our stock market. If we are counting on those folks to hike outlays for homes and automobiles – wouldn’t it also argue against whacking that same group with higher taxes? Moreover, isn’t this the same “trickle-down” theory that the Left has so categorically rejected?

No one knows how the gigantic explosion in the Fed’s balance sheet will be unwound. Bernanke hasn’t explained how he will extricate the bank from its outsized presence in the financial markets, perhaps because he has no idea. A report just out from Bank of America predicts the Fed will own more than one third of the entire mortgage market and two thirds of all long-term government bonds by the end of 2014. That’s one heck of a lot of unwinding.

If lifting confidence is the goal here, it’s a heavy lift. Already, markets are giving ground as real economic issues – like the impending fiscal cliff-- overtake Fed pump priming. Americans are not stupid; they see the Fed buying up 70 percent of the Treasury bonds being issued to fund our debt. They know that can’t go on forever. They wonder; who will fund our careless government then?