It is often the case that economic indicators move simultaneously in opposite directions. Trying to figure out which ones are giving an accurate picture of the economy can be a daunting task. What tends to happen is a herd effect where for a while markets fixate on one set of indicators pointing in one direction and then suddenly switch and start fixating on those pointing in the opposite direction. This is one explanation for the recent volatility in financial markets.

For some time, financial markets were optimistic. Growth was rising, but not so fast that it fueled inflation or pointed to tighter money by the Federal Reserve. This was a Goldilocks period in which everything was just right for making money in stocks or bonds.

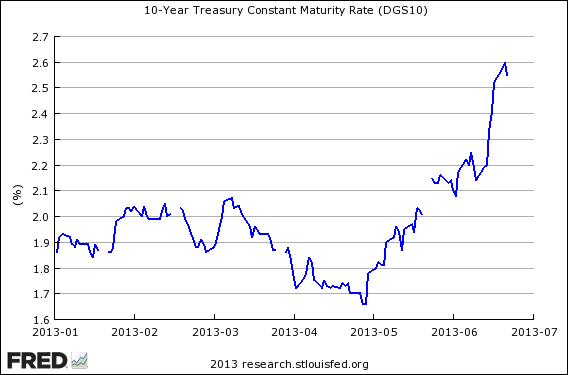

The problem was that this combination of circumstances was unsustainable. In particular, everyone knew that interest rates eventually had to rise to their normal level—they have been very low by historical standards for years. That meant potentially big losses for everyone invested in bonds—when interest rates fall, bond prices rise; when interest rates rise, bond prices fall.

RELATED: EDGY ABOUT INTEREST RATES? DON’T POP THE XANAX YET

Rising interest rates also affect stocks because people have been investing heavily in those with a good dividend yield in order to get a better return than they could get on bonds. Thus higher bond prices and higher stock prices went together nicely.

When interest rates began rising a few weeks ago, the stock’s market’s first reaction was very negative. The easy money to be made buying stocks with high dividend yields was over because such stocks rise and fall to a certain extent with changes in interest rates just as bonds do.

As markets absorbed the idea that interest rates have bottomed and will probably rise for the foreseeable future, however, they began focusing on why rates are rising because some causes of higher rates are very positive.

If the rate of return on capital is rising, it stands to reason that businesses will borrow more for investment, thus increasing the demand for funds and raising rates. This is unambiguously a good thing.

Another reason for rising rates might be that businesses are getting back pricing power; that is, the ability to increase prices after a long period in which it was almost impossible to do so. Businesses have been able to offset this deflationary pressure by slashing costs, especially labor costs, by laying off workers, cutting hours, replacing labor with technology, and outsourcing production to places with low labor costs such as China.

RELATED: NATIONAL DEBT COULD SKYROCKET AS INTEREST RATES RISE

But there is a limit to how far this can go. Chinese wages are rising rapidly, thus undercutting its cost advantage. Rising rate will make it more expensive to replace workers with technology. And rising sales eventually require the hiring of additional workers. Indeed, many businesses report labor shortages for workers with needed skills.

One area of particular concern is the housing market. To some extent, it acts like the bond market. When interest rates fall, people can afford more expensive homes and thus homebuyers bid up prices. Thus economists fear that rising interest rates will have the opposite effect and abort the nascent recovery in home prices, which have a long, long way to go to get back to pre-crisis levels.

Thus far, the housing market appears unaffected by rising interest rates; indeed there is evidence that they are stimulating home buying as potential buyers are motivated to buy quickly before rates rise further.

It is my experience as a sometime real estate investor that potential buyers are actually motivated more by the prospect of rising rates than they are by rising prices. They know that over a 30-year mortgage they will pay vastly more interest than principal. Therefore, they are more sensitive to rising rates than rising prices in terms of stimulating immediate home buying.

In terms of separating the positive effects of rising rates from the negative effects, it is critical to determine whether market rates are indicating a higher real (inflation-adjusted) rate or a rise in inflationary expectations because both will cause market rates to rise, but with vastly different economic consequences.

If inflation is rising, then the real rate may still be low, but if inflation is flat then higher market rates probably indicate a higher real rate. With inflation pretty much nonexistent in broad price measures—of course, some prices are always rising, but they are offset by others that are falling—this suggests that real rates are indeed rising.

While higher real rates may indicate a rising demand for investment capital, which would be good, they may also be a reaction to Fed tightening, which markets fear. Thus far, there is no evidence of Fed tightening, but markets worry that it’s coming sooner rather than later. I think this concern is premature and overwrought; the Fed will not tighten until it is absolutely certain that the economy is on a sustainable upward path and the unemployment rate is several percentage points lower. That point is well in the future as far as can be seen today.

My personal view is that the good news outweighs the bad. The rise in home prices, as modest as it has been, is a particularly positive sign because so much of the middle class’s wealth is tied up in housing. Rising home prices set in motion a number of highly positive economic developments that can quickly become self-reinforcing.

• Many homeowners with good credit have nevertheless been unable to refinance and save money on their monthly mortgage payments because their mortgages are “underwater,” meaning that their house is worth less than their mortgage. Higher home prices will lift many homeowners above water, allowing them to refinance and free up cash flow for spending, which will raise growth.

• Many workers are unable to move to areas of the country where jobs are more plentiful because they can’t sell their house without talking a loss that they cannot afford. Just being able to sell their house for enough to cover their mortgage will improve the geographical mobility of workers, helping both them and employers in need of labor.

• Higher home prices raise middle class wealth, thus encouraging an increase in spending and lower precautionary saving. In the near term, this will raise economic growth and reduce unemployment—but also push interest rates higher.

The negative knee-jerk reaction in the stock market to very slightly higher interest rates was mistaken, in my opinion. If I am right about why rates are rising, it is bullish for stocks even if rates continue to rise, at least for now.