Wall Street is supposed to be the world's largest and most efficient marketplace. Trillions course through the digital veins of the financial system, efficiently setting prices that reflect today's best information on what tomorrow will bring. Academics tell us it's all based on the fundamentals: The economy, profitability and interest rates.

Professionals know things work differently. Information flows out imperfectly. Insiders covertly trade on non-public information. Sentiment and emotion make arbitrary technical levels important. Right now, with stocks mired in a three-month sideways slide — capping a three-year sideways slide near Dow 18,000 — things don't seem so efficient.

Related: 20 Companies That Have Slashed the Most Jobs in 2016

Stocks can't decide if Federal Reserve interest rate hikes are a positive or a negative. They can't decide if stronger economic data is a good thing or a bad thing. And the stakes are high: The Dow has fallen back below its 50-day moving average and looks vulnerable to another test of the August/January lows as breadth and sentiment crater.

Right now, all that seems to matter in this muddled market is the ongoing strength in energy prices that has pushed wholesale gasoline prices up more than 83 percent from their February low, easing fears of energy-sector bond defaults, bank losses and oil-sector equity price declines.

Of course, what's good for stocks isn't necessarily good for the rest of the economy. Witness the pressure on retail stocks over the past few weeks as quarterly results have revealed a cautious, savings-focused U.S. consumer. The squeeze at the pump has a lot to do with this. From its late March high to its low last week, the S&P Retail SPDR (XRT) lost nearly 14 percent vs. a roughly flat performance for the rest of the market.

Related: From JC Penney to Macy’s, What’s Behind the Retail Bloodbath?

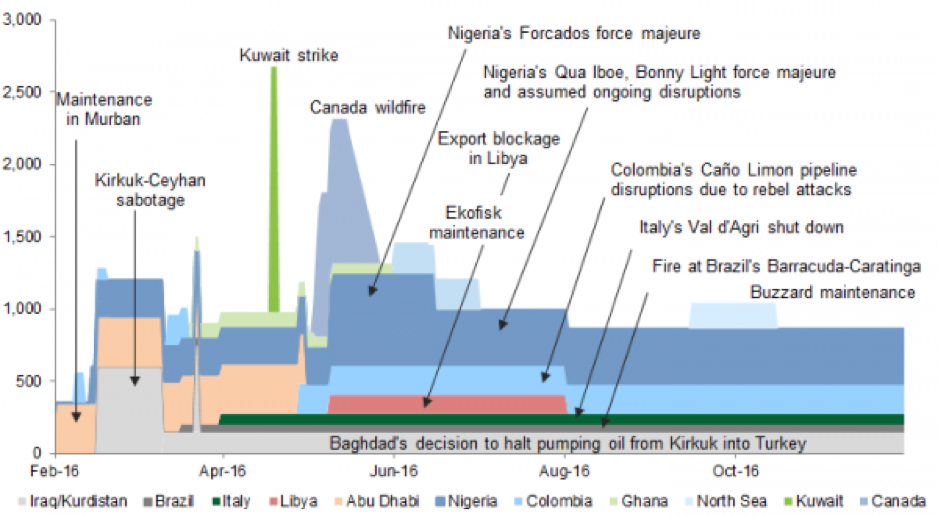

The problem is that the rise in energy prices has been predicated on temporary supply-side constraints such as the wildfire near Canada's oil sands infrastructure, political unrest in Libya and rebel attacks in Nigeria. Analysts are starting to warn that as these factors dissipate, energy prices are looking vulnerable to a pullback — especially given the weakness evident in other economically sensitive commodities like base metals.

These temporary factors are illustrated by Goldman Sachs in the chart below, with the most critical and longest lasting being the situation in Nigeria, which is taking about half a million barrels of Bonny light crude off the market per day.

The problem is that the long-term supply outlook could quickly swamp these temporary setbacks. Goldman expects output growth by low-cost producers (Saudi Arabia, Kuwait, UAE, Iraq, Iran and Russia) to increase by 2 million barrels per day by 3Q17.

Moreover, the supply outages haven't eased a scary inventory accumulation.

Related: Oil Discoveries Sink to Lowest Since 1952

Morgan Stanley's head of energy research, Adam Longson, highlighted a recent Reuters report of at least 40 oil-laden supertankers anchored off the shore of Singapore awaiting higher prices, reflecting a 10 percent week-over-week rise in volume. Total offshore storage in southeast Asia has reached the highest level in at least five years, with similar rises in the Gulf of Mexico and the North Sea.

According to shipbroker Gibson, around 9 percent of the global supertanker fleet is anchored in floating storage. This is a 40 percent increase from December.

As for onshore storage, Genscape notes that inventories at the Cushing, Oklahoma hub reached record levels in May of more than 70 million barrels — very near maximum operational capacity.

Adding to the danger has been a nice rebound in the U.S. dollar, driven by the hawkish tone from the Federal Reserve. Futures traders were only looking for a single rate hike later this year. Policymakers are warning expectations are too low, that folks should expect two or three or even four quarter-point hikes before the year is out. When the dollar strengthens, commodities like oil tend to weaken.

Related: BP's Oil Search Strategy Shrinks With Budget Cuts

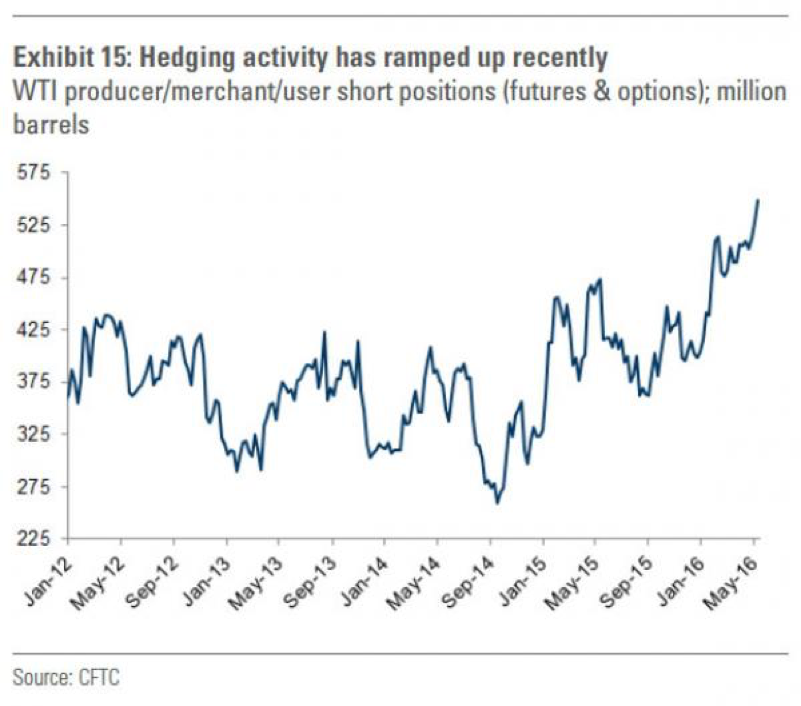

If you don't believe me, consider that oil producers have been aggressive selling the rally in oil as price hedging activity soars to five-year highs. This reflects the "selling" of future production, locking in today's higher prices and offering protection against another bout of energy price weakness.

This will also provide a green light for U.S. shale producers to restart idled wells, ramping up production with the confidence that the selling price has been locked in, pushing the market back into oversupply, swamping remaining tanker capacity, slamming the spot oil market, weakening prices, hurting energy equities and jeopardizing the stock market's tenuous hold on positive territory for the year.