Just weeks after Donald Trump's campaign seemed headed for the same fate as Trump Steaks and Trump Vodka, the man has turned things around.

A series of new polls have shown him closing the gap with Hillary Clinton, or in some cases even ahead. His visit to Mexico was a great success. And after some uncertainty and wavering, he reassured his base with a thundering speech on immigration on Wednesday.

The trouble is: Wall Street, until now, has largely ignored the threat of a Trump victory and has instead focused on the higher probability of a win by "status quo" Clinton. As the calendar flips to September, and the first presidential debate looms in a few weeks, will markets be forced out of their low-volatility ease by the idea of The Donald talking the helm of the Resolute desk in the Oval Office?

Related: Why Corporate America’s Stock Buyback Binge May Be Coming to an End

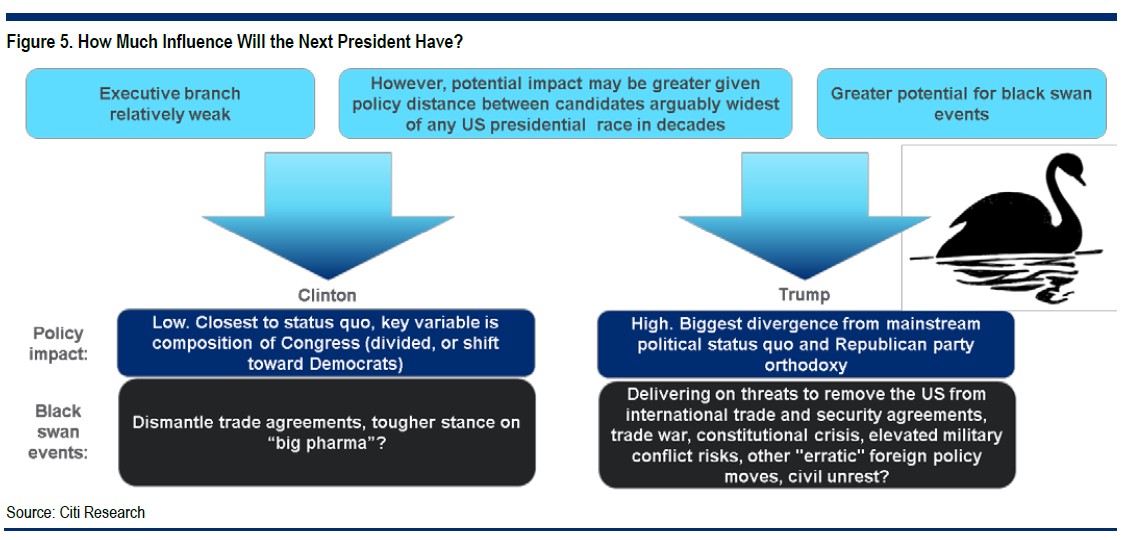

That's a concern, according to Citigroup analysts, who put the odds of a Trump win at 35 percent. They worry that a President Trump would not only rattle stocks — with a predicted selloff of more than 5 percent followed by a pause as equity risk premiums rise — but could raise the chances of slower economic growth or even a new recession if trade is severely restricted and/or his fiscal expansion plans are curtailed or blocked by Congress.

Merely the uncertainty Trump brings could weigh on the global economy at a time of vulnerability. Remember, the Bank of Japan has deployed negative interest rates and is buying up corporate equities. Tokyo is also looking at intervening to weaken the yen, the type of currency manipulation Trump has angrily denounced as unfair to American workers. The European Central Bank has also deployed negative interest rates and is buying up corporate bonds.

Furthermore, Citigroup warns that a President Trump would likely be more bad news for emerging market economies like China, as trade terms would likely be tightened.

The communists in Beijing, already worried about a massive bad debt problem and huge overinvestment in areas like steel mills and solar panel factories, surely awaken in cold sweats fearing higher import tariffs and a declaration by the U.S. Treasury of China as a currency manipulator (something Trump has repeatedly hammered on). I'm sure they're also not happy about his loose talk of possibly restructuring the national debt as well.

Related: Why the Stock Market Is Rooting for Hillary Clinton to Win

Trump's stated desire to repeal and replace Obamacare, touting plans to increase interstate competition by the insurance companies, is a nightmare in the making for health stocks like Unitedhealth Group (UNH). UNH and its peers are already struggling as Obamacare has failed to encourage enough low-cost, healthy, young folks to offset all the sick that have signed up.

Finally, Trump is no fan of Federal Reserve Chair Janet Yellen (and her fellow Democrats on the Fed board) or her prolonged experiment with ultra-low interest rates. Given that the Fed's aggressive policy stimulus is responsible for the bulk of the market's rise since 2012 (thanks, in large part, to the flow of capital from the debt market to stocks via share repurchase programs), a "You're Fired!" to Yellen would likely spook the monetary junkies on Wall Street.

But there could be a lot of positives, too, after the initial shock of a Trump win wore off.

Trump's fiscal plans for increased spending and tax cuts — while they represent a fiscal disaster, according to the Committee for a Responsible Federal Budget and others — may be exactly the type of kick-in-the-rear a growing number of policymakers from the Fed to the International Momentary Fund are clamoring for. Years of cheap money stimulus have dulled the effectiveness of that policy lever. Something new, either tax cuts to empower consumers and/or increased spending on infrastructure, military hardware and other government programs, is now needed to end the post-crisis malaise.

Related: Home Prices Hit an All-Time High — Is This Another Bubble?

Trump has also supported a repatriation "holiday" to allow multinationals to bring capital trapped in foreign subsidiaries back into the United States at a 10 percent tax rate. Citigroup estimates that more than $1.2 trillion is waiting to be brought back home, which could be used to fund investments or share repurchases and dividends.

At the industry level, it's easy to envision positives in a number of major sector groups under a Trump administration. Energy and materials stocks would benefit from his desire for American energy independence and support for mining workers caught out by plans to limit carbon emissions. Financial stocks would benefit from his desire to see the Dodd-Frank reform laws dismantled.

Long story short: Should Trump continue to rebound in the polls, watch for market volatility to increase as investors brace for uncertainty. Citigroup recommends increasing exposure to precious metals like gold as an offset. Yet any associated selloff could prove a buying opportunity.