The Wall Street bulls have had things all their own way over the past seven months, with the "Trumpflation" rally in industrial and bank stocks giving way to the tech rally among the "FAANGs" —Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Alphabet’s Google (GOOGL) — since March. Stocks may be pulling back now as oil prices fall, but the major indexes are still within a hair or their record highs.

Long forgotten is the unpleasantness of 2015 and 2016, the Chinese currency volatility and corporate earnings recession. These worries have been replaced by a persistent faith in the corporate earnings rebound, hope of a GDP bounce back and optimism fueled by the ongoing flow of cheap money stimulus from the European Central Bank and the Bank of Japan despite the Federal Reserve's policy tightening.

Related: Health Care Stocks Rally as Senate Set to Unveil Bill

But cracks have marred the façade. Holes have opened. Let's peer inside.

The FAANGs are no longer invincible. Apple has spent the past two weeks below its 50-day moving average — signaling the first downtrend since November — as its ill-received "Homepod" voice-controlled speaker created some misgivings around the upcoming iPhone 8 launch. Canaccord analysts pooh-poohed all over Alphabet, warning that the advertising gains in mobile search and YouTube of the past two years weren't likely to continue. And even despite Amazon’s purchase of Whole Foods Market (WFM) last week, shares haven’t quite been able to recapture the $1,000-a-share level they closed above to great fanfare earlier this month.

Related: Why Walmart Is Still a Threat to Amazon and Whole Foods

The Fed is shedding its dovishness. Last Wednesday, policymakers raised interest rates, promised another hike before the end of the year and teased the start of a drawdown of the Fed’s $4.4 trillion balance sheet. Janet Yellen said she is looking past recent inflation weakness and focusing instead on the 4.3 percent unemployment rate, a strong antecedent to inflation pressure.

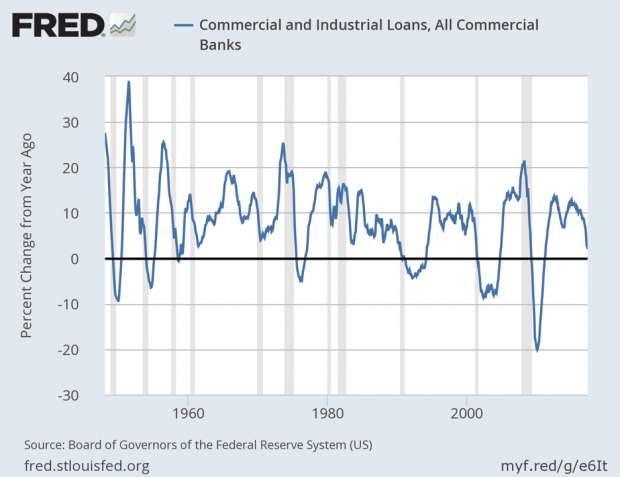

This is far more aggressive than the futures market was hoping for. And for the first time this cycle, the Fed resisted Wall Street's intense pressure to lower its own rate hike forecast to match the market's. It's hard to overstate how important this is given a recessionary-looking decline in commercial loan activity and the persistent decline in long-term interest rates in recent months — both of which are extremely strong pre-recession signals from the lending and bond markets, respectively.

Related: Gundlach Says Flatter Treasury Yield Curve Could Become a Concern

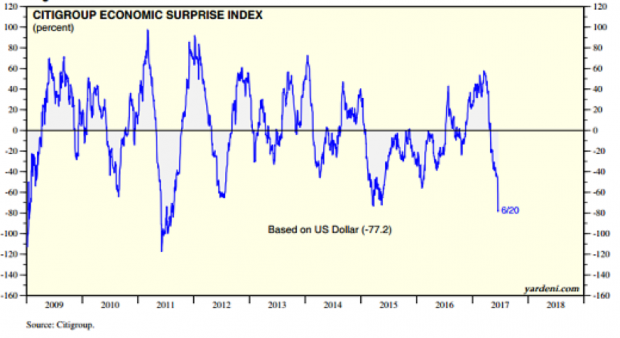

The economic data isn’t encouraging. Aside from the unemployment rate, the macroeconomic data is deteriorating and missing analyst estimates at a pace not seen since the chaos surrounding the 2011 U.S. credit rating downgrade. The bloom has rapidly come off the post-election ebullience.

President Trump isn't delivering. Bogged down by the investigation into Russian election interference and headlines about potential obstruction of justice, Trump hasn’t been able to make much progress on issues like tax cuts, health care reform and infrastructure spending. Republicans in Congress are rushing to push through a health care bill and are still talking up tax reform legislation for this year, but both face huge obstacles. And watch for sparks to fly when issues like the budget and the debt ceiling move to the front burners later this year.

Crude oil is sliding gain. After a year-and-a-half of optimism and higher prices thanks to the OPEC production freeze, the energy sector is moving lower, led by oilfield services stocks. The ramp-up in U.S. shale activity has caused the global oversupply to persist, with demand tepid and inventories still bloated. Lower commodity prices will weigh on corporate earnings in the second quarter.

WTI Crude Oil Spot Price data by YCharts

Market context stinks. Seasonality is horrible this time of the year, with June among the weakest-performing months of the year and the May-October timeframe difficult at best. Sentiment is extremely high. Market breadth has been narrowing for months as the bulls have relied on fewer and fewer stocks to hold the major averages aloft. And valuations are extremely extended.

Jason Goepfert at SentimenTrader notes that when the S&P 500 hit a new high on Monday, it did so with the support of only two major sector groups (and one was defensive in nature). Discretionary, technology and financial stocks haven't hit a new high in the past two weeks.

No surprise then that the breakout immediately failed on Tuesday. Similar breakouts in the past have led to further short-term weakness, according to Goepfert.