Good evening and greetings from New York, where Mayor Eric Adams was indicted today on bribery and fraud charges. Adams is the 110th mayor of New York City and, perhaps amazingly, the first to face criminal charges while in office. Adams, a former captain in the New York Police Department, denied wrongdoing. Will he resign? Fuhgeddaboudit.

Here’s what else is happening.

US Economy Grew Faster Than Previously Thought Since 2021

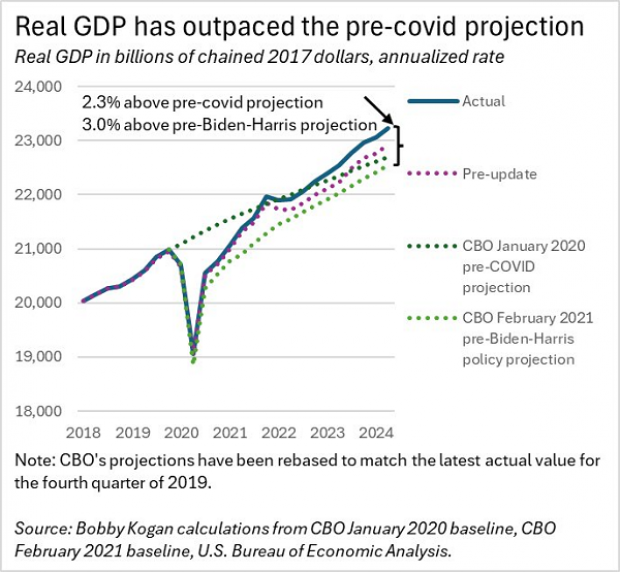

Economic growth since the pandemic has been better than previously understood, according to newly revised data from the Commerce Department.

The department said Thursday that the economy grew at a 3% annual pace from April to June of this year, confirming an estimate issued last month that also showed an acceleration from the 1.6% growth rate of the first quarter of 2024. At the same time, the growth of U.S. gross domestic product has been revised higher for 2021, 2022 and the beginning of 2023, showing the rebound since 2020 was both stronger and more consistent than suggested by the preliminary data.

The United States initially appeared to experience two quarters of negative growth in the first half of 2022, sparking a debate about whether the economy had briefly entered a recession at the start of that year. The revised data lifted the negative growth in the second quarter into positive territory, leaving just the first quarter of 2022 negative, and that period of contraction was less severe than previously reported.

Overall, the revisions mean that the economy is now larger than previously estimated. As this chart from former White House economic adviser Bobby Kogan indicates, GDP is 2.3% larger than expected in estimates made by the Congressional Budget Office before the pandemic hit.

Trump Economic Plan Would Spur Inflation, Slow Growth: Analysis

Former President Donald Trump’s plan to raise tariffs on imported goods and deport millions of undocumented immigrants would be a double whammy for the U.S. economy, reducing economic growth while reigniting inflationary pressure, according to a new analysis released Thursday by the nonpartisan Peterson Institute for International Economics.

In their analysis, the trio of economists — Warwick J. McKibbin, Megan Hogan and Marcus Noland — considered different scenarios suggested by Trump’s proposals, including the deportation of more than 1 million migrants, the imposition of 10% higher tariffs on all imported goods (60% for those from China), and the weakening of the ability of the Federal Reserve to respond independently to changing conditions. In virtually all scenarios, the analysts found that the U.S. economy would be worse off with the Trump policies than without.

“We find that ironically, despite his ‘make the foreigners pay’ rhetoric, this package of policies does more damage to the US economy than to any other in the world,” the analysts wrote. “They result in lower US national income, lower employment, and higher inflation than otherwise.”

In one scenario, the U.S. deports 1.3 million people and raises tariffs without retaliation from other countries, starting in 2025. This produces a decline in employment of 2.7% by 2028 relative to the baseline, with prices rising 6% by 2026.

In a more drastic scenario, the U.S. deports 8.3 million people and other countries retaliate with higher tariffs of their own. This produces a decline of employment of 9% by 2028 relative to the baseline, with prices rising 9.3% by 2026.

The analysts found that the most harmful policy proposal would be deportation. Falsely claiming that immigrants are “stealing” jobs from Americans, Trump has called for deporting 15 to 20 million people. One of the paper’s authors told CNN that mass deportation would cause a shock to the economy similar to the one experienced during the pandemic.

Quotes of the Day: Harris’s Economic Message

“The message here seems to be ‘pragmatism,’ which I take as a swipe at four-plus decades of G.O.P. answers of tax cuts and deregulation, regardless of the question.”

− Jen Harris, a former economic official in the Biden White House, in a New York Times analysis of Vice President Kamala Harris’s new 82-page economic plan and how it compares with proposals from former President Donald Trump.

“To a remarkable degree in a deeply polarized country, Ms. Harris and Mr. Trump have many of the same stated goals for the economy. Lower costs. Reduce regulations. Cut taxes for the middle class. Incentivize corporations to build their products in the United States,” Times reporters Andrew Duehren and Jim Tankersley write. “It is on the methods for accomplishing those ends — and the best way to sell them to the public — that they diverge sharply.”

Duehren and Tankersley note that Harris now has a more detailed economic plan than Trump, and that many economists “have warned that Mr. Trump’s promises, if turned into concrete policy, could slow growth, raise consumer prices and balloon the federal deficit.”

Still, they point out that Harris’s plan are less specific than those offered by previous Democratic candidates. “Her advisers are in no rush to fill in the blanks,” they add. “Instead, they are trying to use her existing proposals to fuel a broader message: that Ms. Harris is a pragmatic capitalist focused on the middle class and not the communist comrade Mr. Trump caricatures her to be.”

“What they needed to do is get the economy to a draw, and arguably they’ve done that already. It’s no longer this unique Trump strength.”

− Republican pollster Patrick Ruffini, in a separate New York Times article looking at how Harris has eroded Trump’s edge on the economy and hopes to win over voters on the issue by working to show she is attentive to the concerns of the middle class.

“In June, Mr. Ruffini’s monthly national survey showed Mr. Trump with an 11-point edge on the question of who would make the economy work better over President Biden,” the Times reports. “That lead had shrunk to a single percentage point over Ms. Harris in late August, and in September she held a one-point edge.”

The Times notes that Harris’s campaign has spent about $35 million to broadcast three economic-themed commercials nearly 55,000 times, according to data from ad-tracking service AdImpact.

Number of the Day: $7.9 Billion

President Joe Biden on Thursday announced $7.9 billion in aid for Ukraine ahead of an Oval Office meeting with Ukrainian President Volodymyr Zelensky.

“For nearly three years, the United States has rallied the world to stand with the people of Ukraine as they defend their freedom from Russian aggression, and it has been a top priority of my administration to provide Ukraine with the support it needs to prevail,” Biden said in a statement. “In that time, Ukraine has won the battle of Kyiv, reclaimed more than half the territory that Russia seized at the start of the war, and safeguarded its sovereignty and independence. But there is more work to do.”

Biden said he had authorized $5.5 billion for equipment through his presidential drawdown authority, ahead of a deadline at the end of the month to use the funding approved by Congress. The president said another $2.4 billion in security assistance from the Defense Department would provide Ukraine with additional air defense, unmanned aerial systems, and air-to-ground munitions, among other uses.

“Through these actions, my message is clear: The United States will provide Ukraine with the support it needs to win this war,” Biden said.

Zelensky had addressed the United Nations General Assembly in New York yesterday and called for more arms and the ability to strike deeper into Russia as part of a strategy to force Russian President Vladimir Putin to negotiate for peace. The Ukrainian leader also met Thursday with Vice President Harris and members of Congress from both parties.

Fiscal News Roundup

- A Government Shutdown Is Averted for Now — but Two New Spending Fights Loom – Yahoo Finance

- A ‘Constituency of One': How Trump Motivated Johnson’s Spending Strategy – Politico

- Harris Dismisses Trump as ‘Not Serious’ on the Economy in MSNBC Interview – Politico

- Trump’s Plans Could Spur Inflation While Slowing Growth, Study Finds – New York Times

- Kamala Harris’s Campaign Thinks She Can Win on the Economy. Here’s How – New York Times

- Harris Puts Government Intervention at Heart of Economic Policy – Wall Street Journal

- US, EU Near Deal on $50 Billion Ukraine Aid Using Russian Assets – Bloomberg

- Biden Pledges $7.9B in Military Aid to Ukraine Ahead of Zelenskyy Meeting – Politico

- Israel Says It Secured $8.7 Billion Military Aid Package From US – The Hill

- US Economy Grew at a Solid 3% Rate Last Quarter, Government Says in Final Estimate – Associated Press

- US Jobless Claims Dip to Four-Month Low, Defying Hiring Slowdown – Bloomberg

- Senate Votes to Hold Steward Hospital CEO in Criminal Contempt – Washington Post

- Effort to Force Vote on Social Security Bill Stirs Unrest in House GOP – The Hill

- CBO: GOP Social Security Plan Would Cut Benefits by Thousands, Not Extend Solvency – Common Dreams

- Ireland Has a Problem Everyone Wants: How to Spend €14.1B Windfall From Apple – Politico

Views and Analysis

- Harris Now Has an Economic Plan. Can It Best Trump’s Promises? – Andrew Duehren and Jim Tankersley, New York Times

- Harris Has a Manufacturing Agenda—in a Fact Sheet – David Dayen, American Prospect

- 3 Takeaways From Kamala Harris’s Interview on MSNBC – Reid J. Epstein, New York Times

- 5 Takeaways From Harris’s MSNBC Interview With Stephanie Ruhle – Alex Gangitano, The Hill

- The Dangers of Donald Trump, From Those Who Know Him – New York Times Editorial Board

- Harris’ Child Care Plan Is Flawed – Kathryn Anne Edwards, Bloomberg

- How Harris’s ‘Opportunity Economy’ Could Finally Free the US From Poverty – Lelaine Bigelow, The Hill

- Trump Offers Scare Tactics on Housing. Harris Has a Plan – Erika D. Smith, Bloomberg

- Harris and Trump Are Offering Radically Different Visions of Manufacturing — and How the Government Can Help in 2025 – Ben Werschkul, Yahoo Finance

- Janet Yellen Defends Her Record – and Delivers a Warning – Victoria Guida, Politico