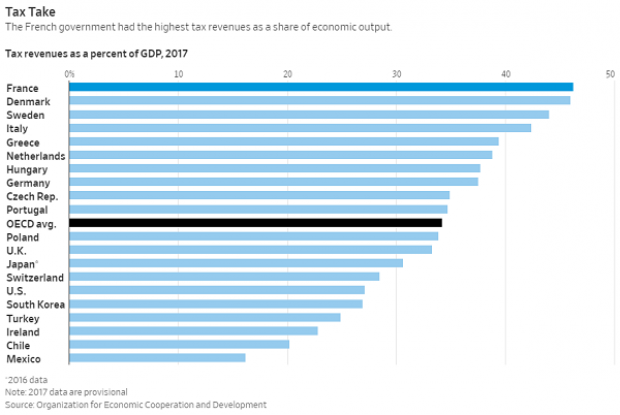

France is now the most heavily taxed developed nation, according to the latest annual review by the Organization for Economic Cooperation and Development. The OECD’s analysis includes federal, state and local taxes.

Total French tax revenues rose in 2017 to the equivalent of 46.2 percent of economic output, pushing France ahead of Denmark, the most taxed nation in 2016.

“The rise in French tax revenues was in line with a longstanding trend across wealthy countries,” The Wall Street Journal’s Paul Hannon said. “The average tax take across the organization’s members edged up to 34.2% of GDP in 2017 from 34% in 2016 and 33.8% in 2000 as governments continued efforts to narrow their budget gaps and limit the rise in their debts that followed the global financial crisis.”

The United States tax level equaled 27.1 percent of GDP in 2017, well below the 36-nation OECD average.