The voices of dissent within the Federal Reserve are growing louder, fueled by concerns that current monetary policy could boost inflation by keeping interest rates too low for too long in a growing economy. In recent weeks at least four Fed officials have suggested that policymakers need to review the current round of quantitative easing program, or QE2. Their comments are raising questions in the financial markets about whether the Fed may cut short its plan to purchase $600 billion of Treasury securities by the end of June, as well as more fundamental questions about how and when the Fed will start to lift interest rates.

The latest discord comes from St. Louis Fed president James Bullard, speaking in Marseille, France, on Saturday. “If the economy is as strong as I think it is, then I think it may be reasonable to send a signal to the markets that we are going to start withdrawing our stimulus, and I’d start by pulling up a little bit short on our QE2 program.” Bullard told reporters, according to Bloomberg News. The current data show that consumer spending is holding up--it rose for the eighth straight month in February despite surging energy and food prices, and economists generally expect another strong gain in payrolls, about 200,000 new jobs, when March numbers are reported Friday. Manufacturing remains on solid footing, and the stock market has held up against grave global events. At the same time, inflation even outside of energy and food has turned up.

Bullard, along with Richmond Fed president and QE2 skeptic Jeffrey Lacker do not have votes on this year’s policymaking Federal Open Market Committee, but everyone gets a say around the big oval table. Dallas Fed president Richard Fisher and Philadelphia Fed president Charles Plosser do have votes and have openly questioned the QE2 program. The notable change in tone in the policy committee’s statement after its Mar. 15 meeting, with more attention to the stronger economy and rising inflation pressure, may partly reflect inflation concerns of the more vocal policymakers.

Growing skepticism of QE2 may put Fed chairman Bernanke in an awkward spot for his first post-meeting press conference on Apr. 27. In an historic move aimed at greater openness in its communication with the public, the Fed after four of its eight meetings this year will release its policy statement at 12:30 pm, instead of 2:15 pm, and at 2:15 pm the chairman himself will address questions on the Fed’s policy actions. Recent statements by several policymakers suggest a lively April meeting with a chance for dissenting votes, which would put Bernanke in the position of justifying the majority decision when he speaks afterwards.

Almost all Fed watchers believe the Fed will carry its planned QE2 through to the end, regardless of the internal discord. Bernanke’s recent testimony and speeches strongly suggest he is committed to finishing the $600 billion in purchases, and his economic views on the program are shared by many on the committee, especially Janet Yellen, the respected Board of Governors vice-chairman, and FOMC vice-chairman and New York Fed president Bill Dudley.

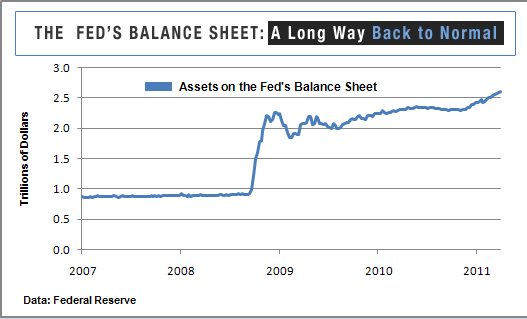

Still, even assuming the Fed does the full $600 billion, the question for Wall Street is what does the Fed do next and when? Economist Michael Gapen at Barclays Capital says comments by Bullard and other committee members in recent days raise a crucial question. After June 30, will the Fed allow its balance sheet to shrink as securities mature, or will it make an active effort to hold the balance sheet at the June 30 level by purchasing enough additional securities to offset the shrinkage? QE2 skeptics would clearly want the balance sheet to shrink sooner rather than later, and if the Fed chooses that path the markets would view it as a passive tightening of policy and a precursor to higher interest rates.

Several events in the past week, on the heels of the Fed’s change in tone on Mar. 15, suggest policymakers are giving increased thought to their exit strategy from the unconventional and unprecedented effort to revive the economy since the financial crisis, say economists at UBS. They believe announcement of the Fed chairman’s post-meeting press conference and a second test of Fed ‘s facility for draining excess reserves from the banking system, coupled with Treasury’s decision to sell off its portfolio of mortgage-backed securities, suggest the Fed is accelerating its preparation for an eventual increase in rates .

Regardless of what it decides in the coming weeks and months, the growing discord within the Fed emphasizes the importance of increased communication of policy decisions after meetings. The unconventional lowering of rates during the crisis will require unconventional tightening, or rate increases, and the markets will need all the information the Fed can supply to function smoothly without disruptions that could damage the recovery.

Related Links:

Fed’s Bullard Says QE Cuts Could Be About $100 Billion (BusinessWeek)

Fed Evans: QE2’s $600 Billion “Just About the Right Number” (Wall Street Journal)