When prominent members of both political parties talk about the possibility of taxing fossil fuels – you know something serious has shifted in U.S. politics.

On Monday morning, former Treasury Secretary Lawrence Summers, a largely pro-business Democrat, published a column in The Washington Post calling for the imposition of a carbon tax.

WHY THIS MATTERS

As the world undergoes an energy revolution, lawmakers will have to figure out ways to fix our crumbling infrastructure and introduce climate policies and economic incentives while balancing the need for continued economic growth.

“The case for carbon taxes has long been compelling,” Summers wrote. “With the recent steep fall in oil prices and associated declines in other energy prices, it has become overwhelming. There is room for debate about the size of the tax and about how the proceeds should be deployed. But there should be no doubt that, given the current zero tax rate on carbon, increased taxation would be desirable.”

Related: As Gas Prices Drop, Gas Taxes Might Finally Rise

Summers’ call for a carbon tax came just a day after prominent Republicans discussed the possibility of an increase in the federal gas tax to shore up the Federal Highway Trust Fund, which will run out of money this May.

The tax has been at 18.4 cents per gallon, without being adjusted for inflation, for more than 20 years. Sen. Bob Corker (R-TN) has advocated raising that tax to match inflation by 12 cents over two years as a means of creating a dedicated source of funding – a sort of user fee – for the federal highway system. Appearing with Corker on Fox News Sunday, Sen. John Thune (R-SD), who will chair the Commerce Committee in the new Senate, said he couldn’t rule out the possibility of raising the tax.

“I don’t think we take anything off the table at this point,” Thune said. “I think it’s important to recognize we have a problem and issue that we need a solution for and we need to look at all the possible ways [to] address the problem.”

Corker’s proposed gas tax is less far-reaching than Summers’ proposal, which presumably would hit all emitters of carbon, from cars to factories. Yet the fact that both sides are even considering a move is notable.

Related: Pope Francis to Rally Catholics Against Global Warming

Summers’ argument for a broader tax is largely economic. “That which is not paid for is overused,” he writes. This applies to energy in the U.S. because the use of fossil fuels creates what economists call “externalized costs.” When a driver burns a gallon of gas in his car, he is paying for all the costs of extracting and refining oil and delivering gasoline to a filling station. However, he is not contributing anything toward the remediation of the effects of air pollution caused, in part, by his own vehicle’s exhaust.

The same argument applies to power plants that release damaging emissions or foul waterways. The full price of their operations is not reflected in their costs. A carbon tax would attempt to capture the currently externalized costs of burning fossil fuels – basically compensating broader society for the costs it now bears to the advantage of people and companies that use large amounts of carbon-emitting energy.

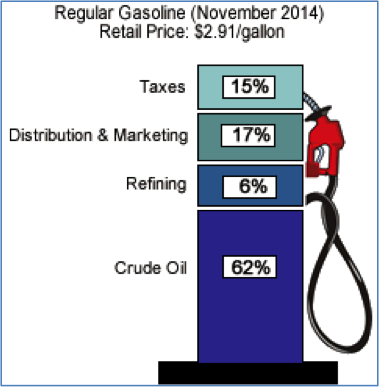

Source: U.S. Energy Information Administration

To be sure, any increase in taxes at the producer level would ultimately find its way to the consumer. Economic pressures, however, cut both ways. Producers compete on price, and if one method of production or delivery becomes expensive, it should spur innovation to find cheaper alternatives. Consumers reward producers who offer lower cost by giving them more business, and cleaner energy becomes a competitive advantage.

Yet as Jared Bernstein, a senior fellow with the Center on Budget and Policy Priorities, pointed out on his blog Monday, a modest increase in the gas tax might be all that advocates of taxing carbon can reasonably hope for.

Related: States Are Spending More as Economy Improves

“[I]t’s probably more realistic – or less unrealistic – given the makeup of the new Congress and where they are on taxes to think smaller and more targeted,” wrote Bernstein, who has argued for raising the gas tax.

“A gas tax is, of course, also a tax on carbon, but a few cents a gallon (say a nickel/gallon a year phased in over three years) won’t be felt by drivers either now or even down the road when gas prices go back up.”

Top Reads from The Fiscal Times: