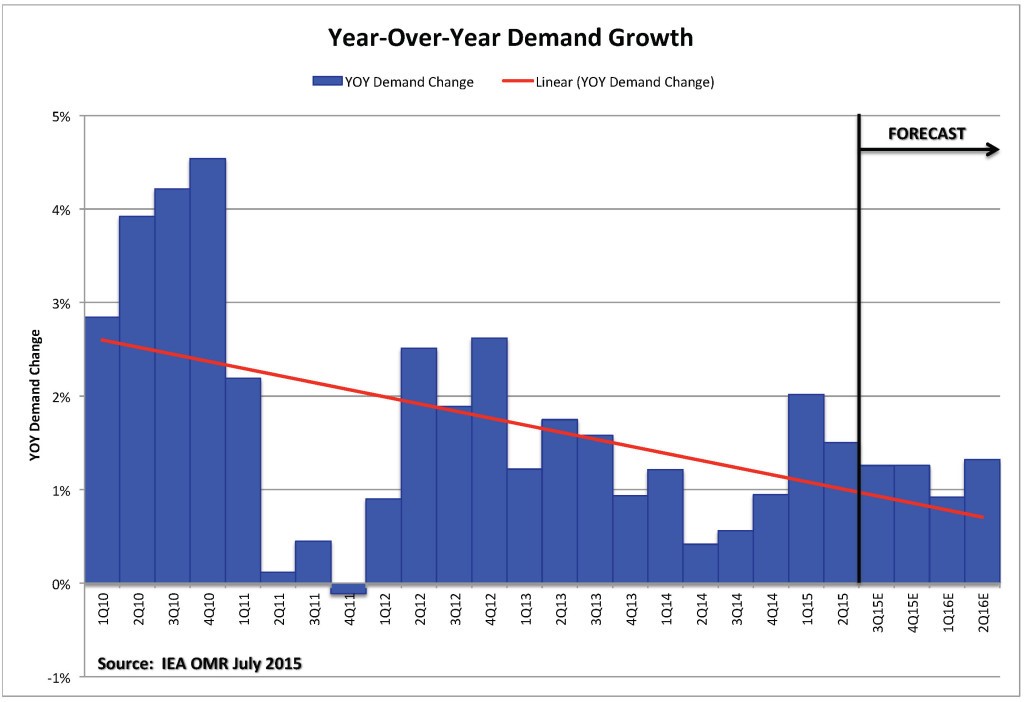

The news from the International Energy Agency is not good. A recent report on the global market states: “World oil demand growth appears to have peaked in 1Q15 at 1.8 million barrels per day and will continue to ease throughout the rest of this year and into next as temporary support fades.”

I don’t have great faith in forecasts but the data shows declining demand growth from late 2010 to the 2nd quarter of this year (Figure 1).

Figure 1. Year-over-year demand growth, 2010-2015. Source: IEA and Labyrinth Consulting Services, Inc.

The weak global economy is the cause of low demand growth. The current debt crisis in Greece and collapsing stock markets in China are the latest alarm signals.

Related: China’s Stock Meltdown: How Far Will the Ripples Go?

Last week, the IMF lowered its world economic growth outlook because of these problems. “We have entered a period of low growth,” said Olivier Blanchard, the IMF’s chief economist.

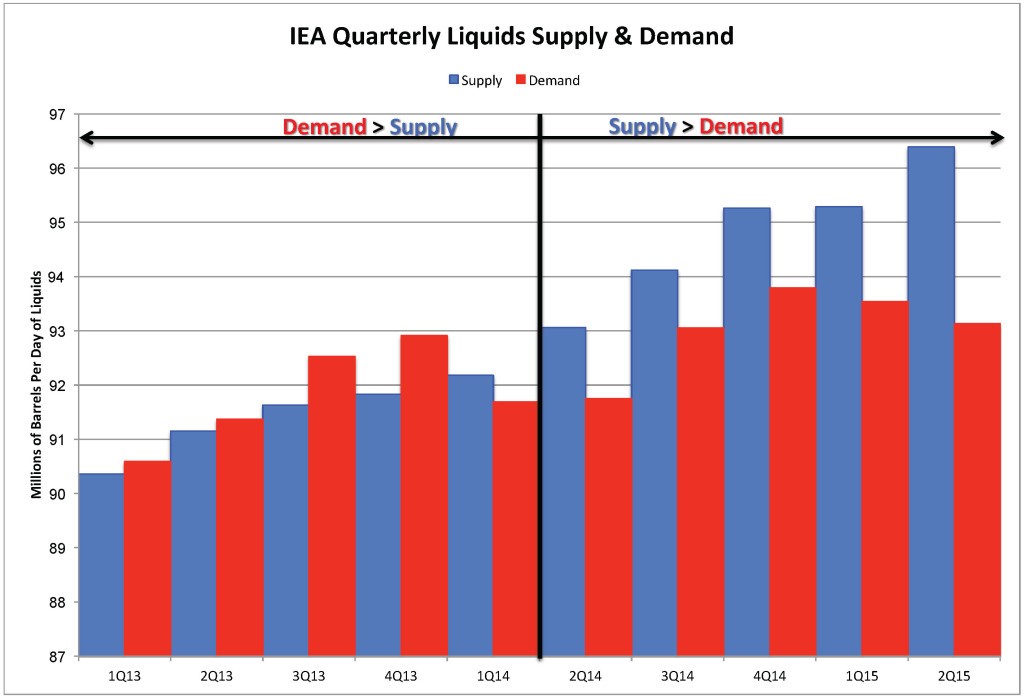

IEA data shows that world liquids production increased 1.1 million barrels per day compared with the 1st quarter of 2015, and demand fell by 410 thousand barrels per day (Figure 2). Half of the production increase occurred in June 2015.

Figure 2. IEA quarterly liquids supply and demand.Source: IEA and Labyrinth Consulting Services, Inc.

George Soros, Warren Buffet, major hedge funds and other savvy investors all have their eyes on Argentina and the massive undeveloped shale reserves they have just opened up to outside oil companies.

The production surplus (supply minus demand) that is responsible for low oil prices continues to increase (Figure 3).

Figure 3. World liquids production surplus or deficit. Source: IEA and Labyrinth Consulting Services, Inc.

The price of Brent crude has fallen from $65 in late June to approximately $58 today.

Related: Greece and Iran Are Taking Oil Prices for a Ride

Current events in Greece and China and a possible deal with Iran occur against the backdrop of a growing world oil-production surplus. This surplus consists of two components: over-production and weakening demand growth. Of the two, over-production is the easier problem to solve.

Unconventional production has not declined meaningfully so far and OPEC seems determined to maintain or increase its production. The standoff will be resolved by lower prices. Clearly, the few months of lower oil prices in late 2014 and early 2015 were insufficient to force unconventional production lower. A longer period of much lower prices may be needed.

Top Reads from The Fiscal Times: