YouTube Red announced this week that it had bought its first big-budget television series. The video streaming giant (itself part of internet behemoth Google), declared that it had won the race to produce a television extension of the Step Up movie franchise.

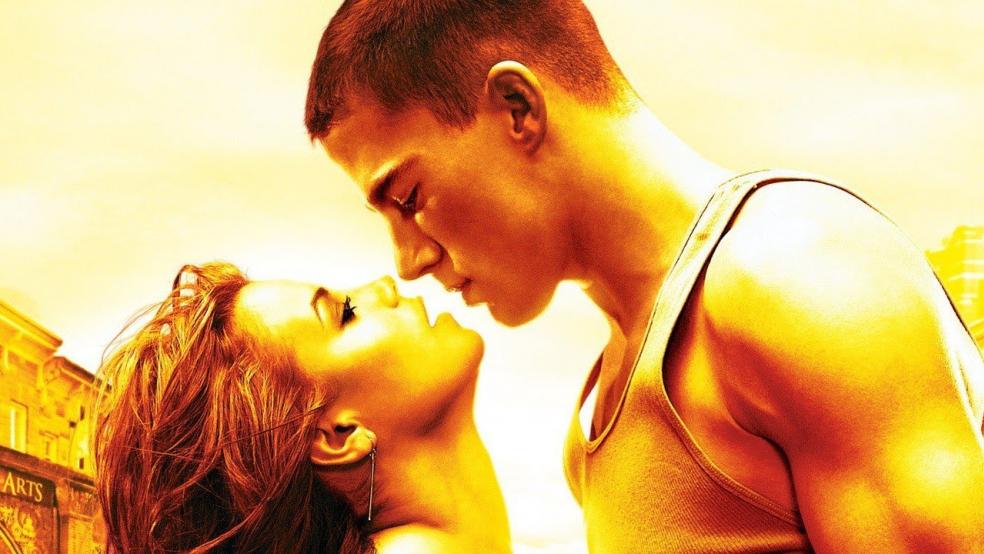

The popular teen dance drama series produced by married couple Channing Tatum and Jenna Dewan Tatum (who starred in and met on the first entry in the franchise) makes a certain amount of sense for YouTube. The show, like the films, would presumably be light on plot, heavy on music, dance and style.

Related: Can Game of Thrones Hold on to the Crown?

For a $9.99 subscription fee, viewers would also gain access to YouTube’s music library, potentially helping the service position itself as a competitor to Spotify and Pandora. The subscription would also provide access to the other offerings in YouTube Red’s line-up.

The under-the-radar popularity of the franchise — it has made over $650 million at the box office despite its youthful demographic and lack of “serious” subject matter, which narrow its appeal — could make this the ideal franchise to finally put YouTube Red on the same field as Netflix, Amazon Prime and HBO Go. But questions remain about the service’s ability to compete in an already overcrowded market, even with the muscle of Google behind it.

YouTube certainly believes it’s the right move, greenlighting a 10-episode run with a budget expected to be several million dollars per entry.

The announcement comes just as YouTube’s overall business face challenges on two fronts.

Earlier this month, 180 musicians, including luminaries ranging from Sir Paul McCartney and U2 to Taylor Swift and Lady Gaga, all signed a petition asking Congress to reform the copyright laws applying to YouTube. For years now, nearly any song you wanted to hear could be found on YouTube for free as long as you were willing to watch a commercial. While the revenue stream gives YouTube an incentive to develop its own music platform, the musicians themselves have gotten little to none of this ad money. And YouTube’s music offering will face the typical online challenge of convincing users to pony up for something they are used to getting for free.

Related: Why the Massive Success of ‘Star Wars’ Will Be Terrible for Movies

Additionally, Facebook, which is increasingly becoming Google’s chief rival for internet dominance, has begun aggressively promoting itself as a video and livestreaming platform. Though the social media site hasn’t yet taken the bold step of producing original content — and might never go there — the ubiquity of its app means that it has a built-in audience for whatever it tries.

On top of all that, YouTube Red is pushing deeper into the original content game at the exact moment when critics are crying that we’ve reached “peak TV,” and the backlash to the swelling stream of video content has really gotten into full swing. Increasingly overwhelmed by the myriad viewing options, viewers now find there is just too much good television to keep up with. Even those who get paid to watch TV for a living can’t handle the swarm of “buzzworthy” shows.

This is not YouTube’s first attempt to present itself as a competitor to Netflix, either. In 2012, Google dumped several hundred million dollars into the YouTube Original Channel Initiative. It was shuttered the next year, to be replaced in 2014 with YouTube Red. Red’s initial attempts were centered around what YouTube called “influencers,” such as famous gamer PewDiePie and cult webseries like High Maintenance.

Related: Why Hollywood No Longer Saves Its Biggest Movies for Summer

While some in the entertainment industry have certainly underestimated both the Step Up franchise and the youth market before, there are reasons to be skeptical that this series will succeed where YouTube’s past efforts failed. Netflix had its disc-in-the-mail business model to ensure that it already had a large subscriber base when the transition to streaming occurred. Amazon was able to leverage the offer of free delivery on purchases to lure people into Prime. HBO is still first and foremost a traditional premium cable channel (the traditional premium cable channel) despite its impressive online offering. YouTube is still first and foremost thought of as a free service for quick videos.

Beyond that, as many of its potential customers already subscribe to competing offerings, and at least at present are unlikely to change that, the number of subscription services available begins to become overwhelming, particularly for the younger demographic being pursued. Do they have enough change left over for one more monthly bill?