The home flippers who were banking huge profits during the run up to the housing crisis are back, and they’re making more money than ever.

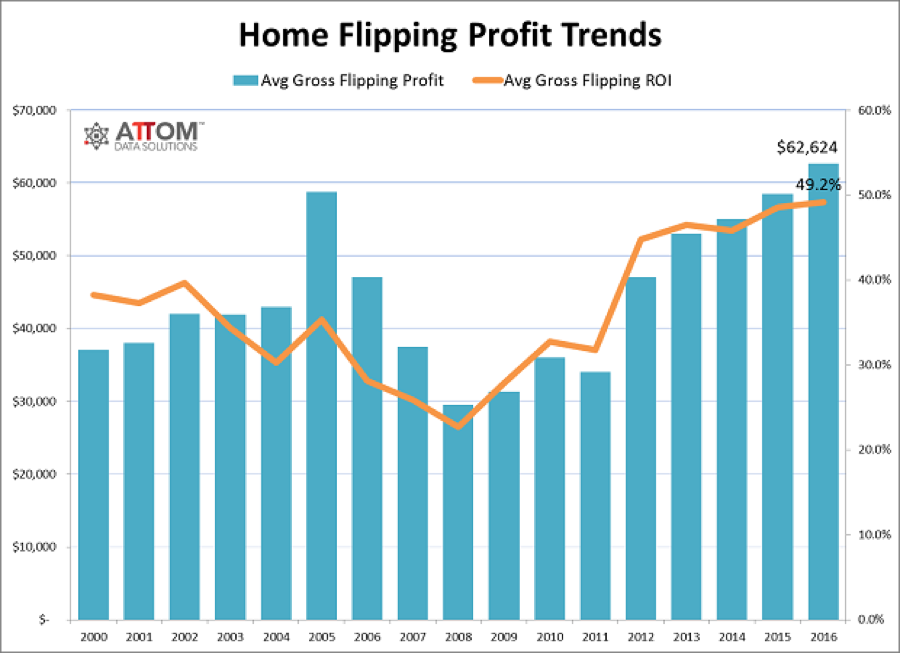

More than 190,000 properties were flipped in 2016, the highest number since 2006, and flippers earned an average gross profit of nearly $63,000, according to a new report from ATTOM Data Solutions.

Related: The 15 States Americans Are Ditching

That’s about $10,000 more than the median family income in the U.S., and roughly equals a return on investment of 49 percent, the highest since at least 2000.

The increase in flips -- defined as homes bought and sold within the same year -- reflects a low inventory of homes for sale, particular those in move-in condition. Investors are increasingly looking into secondary markets, which have older, smaller houses that can offer a better return. Flippers in East Stroudsburg, Pennsylvania, saw the highest returns (130 percent), followed by Cleveland (116 percent) and Philadelphia (107 percent).

Still, flips make up a fairly small portion of the market. They accounted for just 5.7 percent of home sales, up slightly from last year. In some areas, however, flipping is a much bigger part of the market. There were 39 zip codes in 12 states across the country where flippers represented one in five home sales.

More flippers are starting to use financing to purchase their properties, borrowing a collective $12.2 billion. Nearly a third of flippers borrowed money, the highest percentage since 2009.