The longer U.S. troops remain in Iraq and Afghanistan, the greater the financial costs to the United States. Taken together, the cost of those wars could be as high as $6 trillion, including medical and disability care for vets and all their families and a host of other expenses such as rising interest charges on the debt that finances military operations.

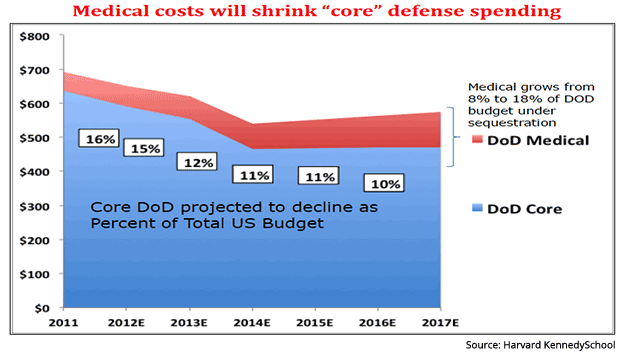

The sobering analysis comes from a 2013 paper by Linda J. Bilmes of the Harvard Kennedy School, “The Financial Legacy of Iraq and Afghanistan: How Wartime Spending Decisions Will Constrain Future National Security Budgets.” Bilmes contends that the money spent on these wars since 2001 will “dominate future federal budgets for decades to come.”

Related: A Military Surge Would Push US War Costs in Afghanistan Over $2 Trillion

Defense spending is certainly dominating the Trump budget, especially in relation to the programs that benefit low- and middle-income families and individuals, which he intends to cut by 50 percent.

Aside from paying for the arsenal of weapons, including the investment in fighter planes, drones, helicopters, aircraft carriers, tanks and the like, the money spent on the star-crossed F-35 -- which is expected to cost $1.5 trillion over the 55-year life of the program -- puts the hardware budget over the top.

What will be left for cyber security? Siphoning away talented tech engineers from Google and Amazon comes at a price (assuming they come at all). But the Pentagon needs them if they’re going to compete and win against China and Russia.

The most unsustainable costs from the wars are the long-term outlays for veterans’ health care. Bilmes says it took more than 50 years after the Armistice in 1918 to reach the maximum payout for disabled veterans of World War I. The wars in Iraq and Afghanistan have seen fewer deaths thanks to advances in medical triage. But the number of wounded vets has exploded.

Related: Losing the War on Heroin: Poppy Production Soars in Afghanistan

The massive number of disabled vets require expensive prostheses to replace lost limbs, multiple surgeries to rebuild faces, and enough personnel to handle the volume. The Department of Veterans Affairs has fallen woefully short of its duty to care for veterans.

In one of the worst in a series of scandals at the VA in July 2014, the department was accused of shredding, hiding or losing tens of thousands of benefit claims from injured soldiers returning from Iraq and Afghanistan to create the illusion of operating efficiently. An earlier scandal in Phoenix, Arizona, had so many veterans waiting for appointments to see a doctor that 40 of them died allegedly because of neglect.

Bilmes wrote a piece on Memorial Day about the unpaid bills for vets that will realign the nation’s priorities. She said, “The high rates of injuries and increased survival rates in Iraq and Afghanistan mean that over half the 2.5 million who served there suffered some degree of disability. Their health care and disability benefits alone will easily cost $1 trillion in coming decades.” She points out that instead of covering these costs through budget appropriations, “we have charged them to the national credit card.”

Related: How the US Wasted Billions on Broken Highways in Afghanistan

In past wars, including Korea and Vietnam, tax rates were raised on wealthy Americans. America still had the draft during those wars, where the rich fought side-by-side with middle-class and the poor. In this century, most of the soldiers on the front lines are not the sons and daughters of the one-percent. All the more reason, many assume, for the wealthy to pay more.

Raising taxes is a non-starter for this administration, so Bilmes is supporting another idea that could avoid a fiscal debt crisis. It’s a bi-partisan proposal to create the Veterans Health Care Trust Fund Act. We apparently have more than 200 trust funds, including funds for Social Security, Medicare, highways, and unemployment.

This is a good idea. We should do it. Then we can go back to worrying that our kids will only have about $100 trillion in existing debt and unfunded government liabilities to deal with. Phew!