The Tax Policy Center issued a new report Wednesday that takes another look at the winners and losers from the Tax Cut and Jobs Act.

Overall, TPC says 65 percent of households in the U.S. will get a tax cut in 2018, while 6 percent will see a tax hike. High-income households will see the biggest cuts, both in dollar terms and as a percentage of after-tax income, “particularly those in the 95th to 99th percentile of the income distribution.” Only 27 percent of households in the bottom quintile will see a tax cut.

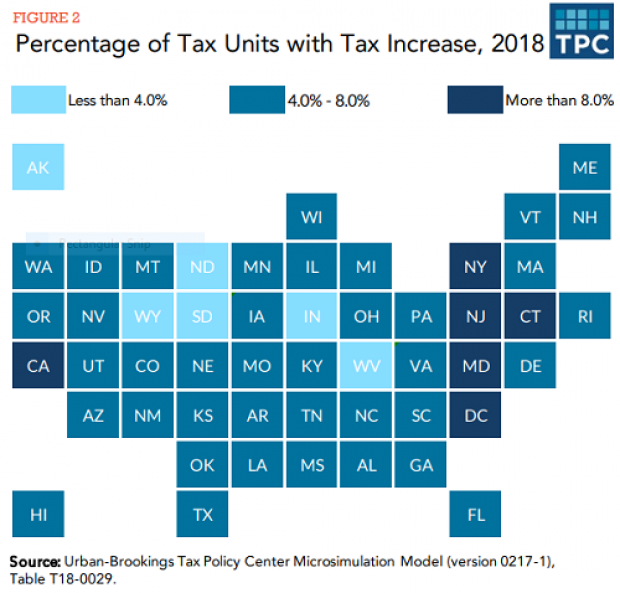

At the state level, TPC estimates that residents of high-tax states will see smaller tax cuts on average; individual tax cuts for residents of New York, California and Oregon will be below 1.5 percent of after-tax income.

The loss of state and local tax deductions will hit some high-tax state residents particularly hard. The chart below shows the percentage of households in each state that will see tax increases, with New York, New Jersey, Connecticut, Maryland, and California having the highest proportion.