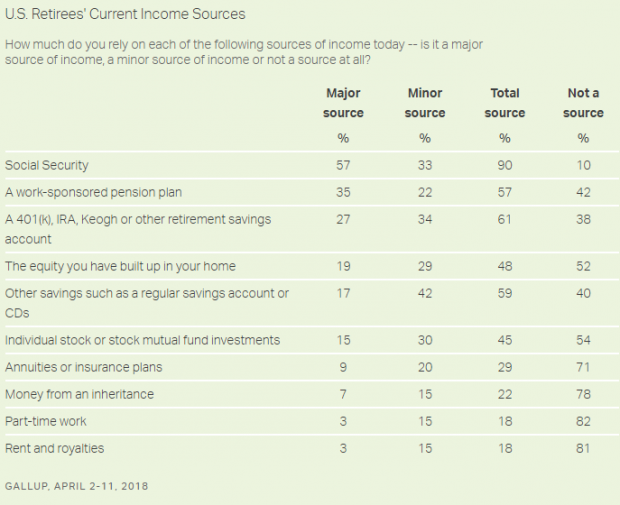

Social Security once again tops the list of major income sources for U.S. retirees — just as it has every year since 2001, according to a new Gallup survey.

Almost six in 10 U.S. retirees surveyed by Gallup said they rely on Social Security as a “major source” of their income, a far higher percentage than work-sponsored pensions (35 percent) or 401(k)s and other retirement savings plans (27 percent). Another 33 percent of retirees called Social Security a minor source of income.

Those findings haven’t changed much over the years, Gallup’s Lydia Saad writes, except that 27 percent of retirees are now more likely to say that a 401(k) or other retirement account is a major income source, up from 19 percent in 2002.

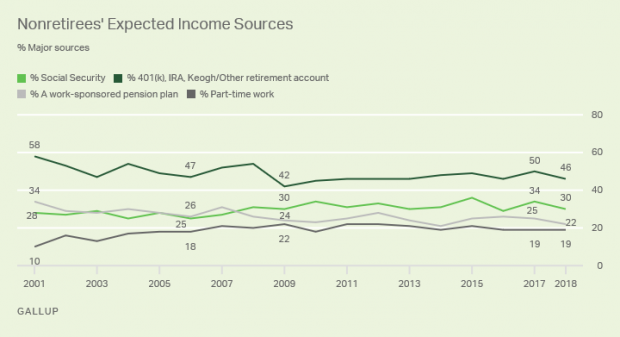

But while most retirees rely on Social Security, Americans who haven’t yet retired expect to depend on it less in the future. Just 30 percent say they think Social Security will be a major source of income in retirement, compared to 46 percent who say the same for 401(k) and other personal retirement savings accounts. “With ongoing reports that the solvency of Social Security is in jeopardy, nonretirees have, for almost two decades, remained fairly skeptical of how important Social Security will be in their retirement,” Saad writes. “Far fewer nonretirees predict it will be a major source of retirement income for them than current retirees say it is for them today.”

Those expectations might shift over time, though. Gallup found that Americans who were near retirement age about 15 years ago are much more likely to call Social Security a major source of income now that they’ve retired. In surveys from 2002 to 2004, 37 percent of people aged 50 to 64 said they expected to rely on Social Security a great deal. Now that they’ve retired, though, 61 percent said they rely on Social Security a great deal, according to surveys from 2016 to this year. “At the same time,” Saad writes, “members of this group are significantly less likely as retirees to be relying on home equity, part-time work, or a 401(k) or other retirement savings account than they expected to before retirement.”