Taxes are the largest single part of the retail price of beer, accounting for roughly 40 percent of what consumers pay at the register, according to the sounds-awfully-fun-to-work-at Beer Institute.

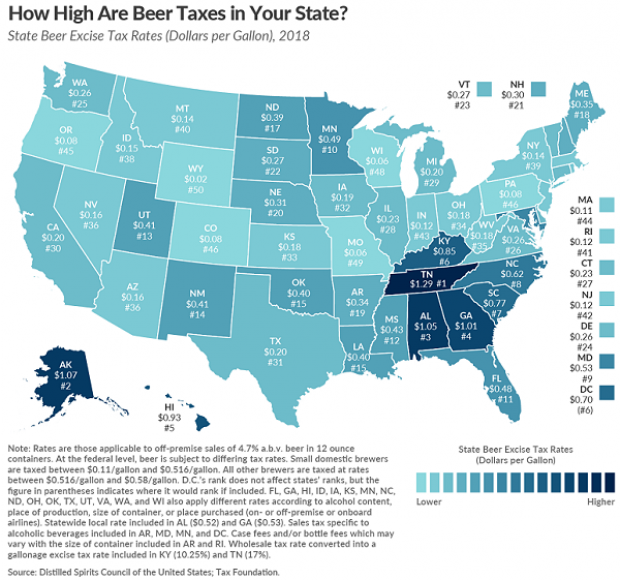

The Tax Foundation mapped variations in state-level taxes on the sudsy stuff, which shows that Wyoming taxes beer the least, just 2 cents per gallon, while Tennessee has the highest tax at $1.29 per gallon.

The tax rules can get complicated, with some states applying different levies depending on the strength of the beer, the location of the brewery, and the size of the container.

Federal taxes create another layer of complexity, adding taxes that vary by the size of the brewery and the level of total production.