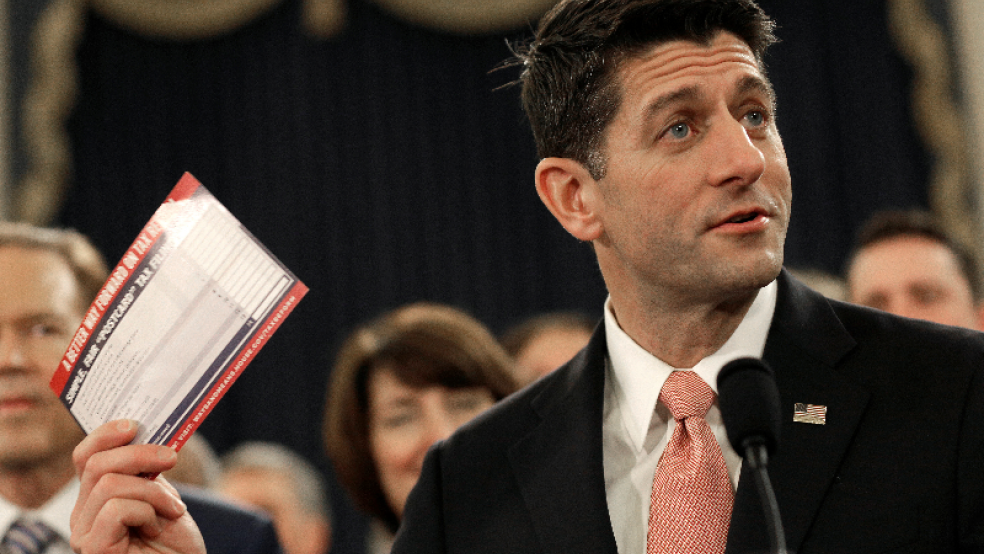

The Treasury Department is expected to release its long-promised “postcard” tax form this week, but the reviews of a draft version published by The New York Times suggest that Republicans have a long way to go before they can claim victory in the struggle against unnecessary complexity at the IRS.

The draft 1040 is indeed shorter, but the reduction in size appears to have been accomplished largely by moving some popular deductions and types of income to separate worksheets. The postcard is also two-sided, and too large to be sent at standard postcard postal rates. And unless you want the whole world to see your Social Security number, you’re going to need to put it into an envelope – along with the six or more supporting worksheets.

“It will save a little bit of time for some taxpayers,” says the Times’ Jim Tankersley, “but could add pages more paperwork for millions of others.”

Here’s what some experts and critics are saying Tuesday about the new form, which is reportedly intended to replace the 1040, 1040A and 1040EZ forms:

* “Stupid tax administration tricks. 1040 replaced by a postcard-sized form plus 6 new schedules. Irrelevant for the 90% of people who file electronically.” – Len Burman, Tax Policy Center

* “As a tax practitioner and an Enrolled Agent, I'm not a fan of the new ‘postcard plus six extra forms’ tax return. It actually makes things a lot more complex, in my opinion. It's like they started with a postcard and worked backwards from there. Better to just clean up the 1040EZ” – Ryan Ellis, Senior Tax Advisor at the Family Business Coalition

* “Well…this is just silly – and wasteful. The IRS has better things to do than shuffling deck chairs on the 1040 and moving items to separate schedules, all so someone can say there’s a postcard.” – David Kamin, New York University

* “I've been a tax preparer for 7 years. This new "postcard" tax form is more than silly. People are going to screw up their taxes because of it. … For people who use the IRS forms to do their taxes, the lines on the form are essentially a checklist for what you need to include and what tax benefits to claim. The ‘postcard’ takes away a lot of lines on that checklist.” – Harry Stein, Center for American Progress

* “It’s important to recall that all of this is completely pointless. The government could — and many foreign governments do — make tax filing completely painless for 95 percent of taxpayers by simply taking the information that’s already been filed by employers and banks and filling the tax form out for you.” – Matthew Yglesias, Vox