When will the next recession hit?

It’s been more than nine years since the Great Recession officially ended, and the U.S. economy is about a year away from passing the 1990s expansion to become the longest in the nation’s history.

“This has understandably raised concerns that the clock is running down on the expansion and the next recession is around the corner,” J.P. Morgan economists Michael Feroli and Ben Jarman wrote in a research note last week. Indeed, a solid majority of 60 private-sector economists polled by The Wall Street Journal in early May said that the next recession will arrive in 2020, and another 22 percent said it would come in 2021.

Writing in The Washington Post, economist Jared Bernstein offers a warning to those focused on the timing of the next downturn — and to policymakers: “Worry less about when the next recession is coming and worry a lot more about what we’re going to do about it.”

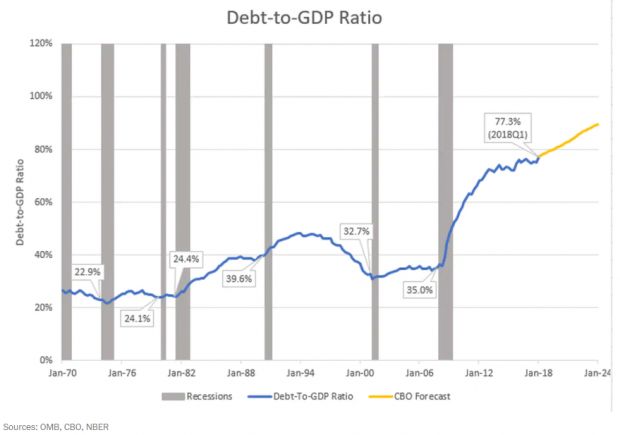

Bernstein has made this point before, but it’s worth repeating: Whenever the next recession comes, the U.S. will be entering it with far less perceived space to enact fiscal policies to counteract the downturn. Entering the past six recessions, Bernstein says, the ratio of public debt to GDP has averaged about 30 percent. When the next recession hits, that ratio will almost certainly be more than twice as high, exacerbated by recent tax cuts and spending increases.

That, in turn, makes it much more likely that politicians won’t act as aggressively to lift the economy out of its funk. “Pointing to the elevated debt level, they’ll devote too few resources to programs like infrastructure or subsidized jobs that go beyond the automatic stabilizers, like unemployment insurance,” Bernstein writes, pointing to recent research that showed just how perceptions of “fiscal space” affected responses to recessions.

Among Bernstein’s recommendations for preparing for the next recession is “to replace the tax cuts with a plan that stabilizes and reduces the debt in periods of full employment, to have more (perceived) fiscal space when we need it.” But you tell us: Are the odds of that happening better or worse than the chances that, say, the Mets win the World Series this year?