The national debt rose by more than $1 trillion in fiscal 2018, and yet lawmakers have evinced little concern about it ahead of this year’s elections, instead pushing tax cuts and spending increases that will only add to the total.

While Congress has largely ignored the issue, fiscal hawks like Brian Riedl still warn that a debt crisis looms.

Riedl, a senior fellow at the conservative Manhattan Institute, published a new report this week, outlining a 30-year plan to avert such a crisis by stabilizing the national debt at 95 percent of GDP. “Without reform, runaway deficits will all but guarantee a debt crisis that will profoundly damage the country’s economic and social order,” he writes. “There is still time to avoid that crisis, but it will require the nation’s fractious political leaders to leave their respective comfort zones and compromise.”

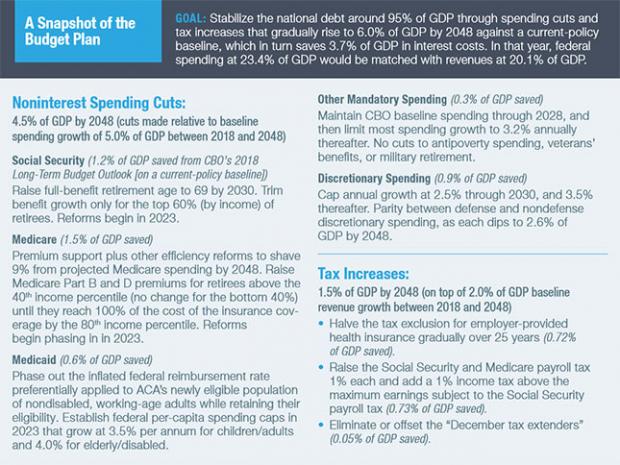

Riedl says his proposal “represents politically realistic solutions rather than partisan fantasies.” It calls for some long-term cuts to Social Security, Medicare and Medicaid, including a shift to a Medicare “premium support” model; a steeper-than-projected decline in discretionary and defense spending; and some tax increases. In all, the balance of spending cuts to tax increases is 70-30. “In short, there is something in this blueprint for everyone to oppose,” Riedl writes. “But letting the country wander into a debt crisis is even worse.” (See a snapshot of the plan in the chart below, or click over to the full report for more details.)

Why it matters: There have been plenty of proposals to stabilize the debt. Riedl’s demonstrates considerable thought — and considerable effort to try to find some middle ground in our hyper-partisan era. “The easiest thing to do is criticize,” David Ditch of the conservative Heritage Foundation tweeted. “This is not what my dream budget would look like (it probably isn't what Brian's would look like!). But if everyone wrapped their arms around the size of the problem and showed their cards, we might be able to work towards common ground.”

But Riedl’s thorough blueprint is also an illustration of just how gargantuan a task it will be to find compromise on these issues.

“What's amazing about the Riedl proposal is that it sets off a goal that at the outset seems relatively modest, and yet the concessions that even the relatively modest goals would require on both sides are well beyond the boundaries of our current political discourse,” says the Washington Examiner’s Philip Klein, adding that “getting Republicans to agree to significant tax increases and Democrats to agree to significant reforms and cuts to Medicare and Social Security is beyond the realm of possibility.”

Even if lawmakers could agree on a compromise — or if one party could gain enough power to single-handedly implement its preferred plan — future congresses could undo that work over the ensuing decades, Klein notes, with ample recent evidence to support the notion. “Sadly,” he says, “it's inevitable that lawmakers are going to ignore the problem so that future congresses can do what they do worst — govern in the midst of a catastrophic economic crisis.”

The bottom line: Riedl writes that his blueprint “is intended to revive serious bipartisan discussion and negotiations.” There’s no sign of that happening in the immediate future, but maybe that can change after the elections. The longer lawmakers wait, the more daunting the challenge will be.