The U.S. government will issue $129 billion of debt this week, a 28 percent increase over the same time last year, and the surge in borrowing is so great that it’s “beginning to warp bond indexes,” says Daniel Kruger of The Wall Street Journal.

Treasurys now make up about 40 percent of the Bloomberg Barclays U.S. aggregate index, the leading bond market investment benchmark. That’s about twice the level seen in 2006, before the financial crisis. Given the increase in U.S. debt issuance, some investors with passively managed bond funds now find themselves owning more government debt than they did a few years ago, and that’s hurting their returns as interest rates rise and bond prices drop. The Bloomberg Barclays index has lost about 2 percent this year.

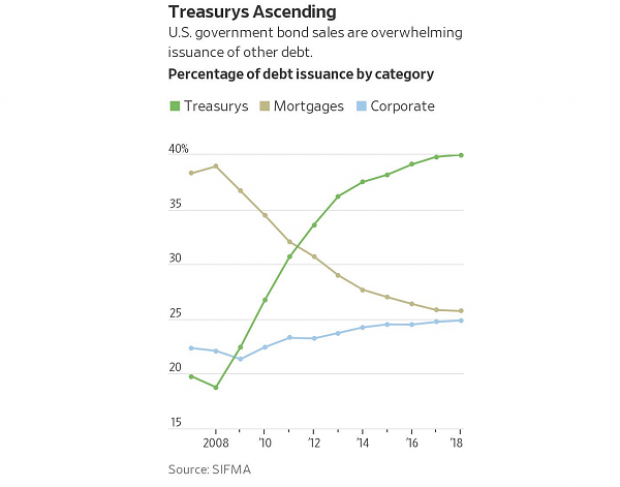

The chart below from the Journal shows the increasing share of Treasurys in the overall debt market.