Without congressional action, Social Security’s costs will exceed its income starting in 2020 — and they’ll stay that way indefinitely, forcing the program to fall back on its nearly $3 trillion trust fund to cover benefits, according to the annual report released Monday by the Social Security and Medicare trustees.

By 2035 — one year later than projected last year — the program’s combined trust funds will be depleted, leaving it able to pay only 80% of scheduled benefits. By 2093, the program would only have enough revenue to pay 75% of promised benefits.

Social Security encompasses two programs, one for retirees and one that provides disability benefits. Considered separately, the fund for retirees is now expected to be depleted in 2034, the same as in last year’s report, while the disability insurance reserves run out in 2052, or 20 years later than projected a year ago. The large change in the disability insurance projection is the result of a continuing decline in new applications and total beneficiaries, the trustees said.

Maintaining Social Security’s solvency for 75 years would require raising payroll taxes by almost 22%, cutting benefits by about 17%, reducing new benefits by 20% or some combination of the approaches.

Last year’s report said that Social Security would be forced to tap into its reserves in 2018 for the first time since 1982. In the end, though, the program’s total income was $3 billion higher than its $1 trillion cost.

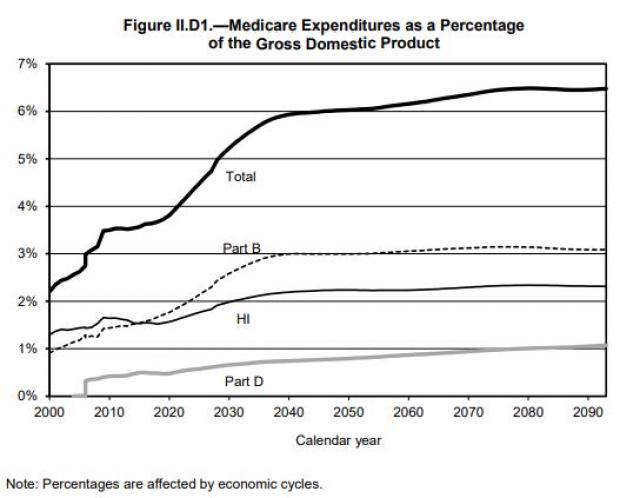

The report also warned that Medicare’s hospital insurance trust fund, otherwise known as Medicare Part A, would be depleted by 2026, unchanged from last year’s projections. The program would then be able to cover 89% of costs, with that figure falling to 78 percent by 2050. (Medicare Parts B and D, which cover outpatient services and prescription drugs, will stay solvent indefinitely because they are paid for by patients’ premiums and general tax revenue.)

As a share of the economy, Social Security’s annual cost is projected to grow from 4.9% this year to 5.9% by 2039. Medicare’s costs are projected to climb from 3.7% of GDP in 2018 to 6% by 2043.

Why it matters, part 1: The numbers overall may not be all that different from last year, but the clock is ticking — and time matters. Monday’s report notes that lawmakers “have a broad continuum of policy options that would close or reduce Social Security's long-term financing shortfall” and adds that making changes “sooner rather than later would allow more generations to share in the needed revenue increases or reductions in scheduled benefits.” But President Trump and Congress are focused elsewhere. “Social Security and Medicare are massive programs, heading toward potentially massive fiscal problems,” PBS Newshour correspondent Lisa Desjardins tweeted Monday, noting that the two programs represent 45% of federal spending. Yet lawmakers and the president are expending most of their energy on issues like money for a border wall.

Why it matters, part 2: The new Medicare numbers are also bound to be a flashpoint in the ongoing debate over Medicare for All and whether, or how, the country can afford such a revamp of the health care system. “That fact that we now can’t guarantee full benefits to current retirees is completely unacceptable, and it should be cause enough for every policymaker to rally around solutions to restore solvency to those programs,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “Certainly we should be focused on saving Social Security and Medicare before we start promising to expand these programs.”