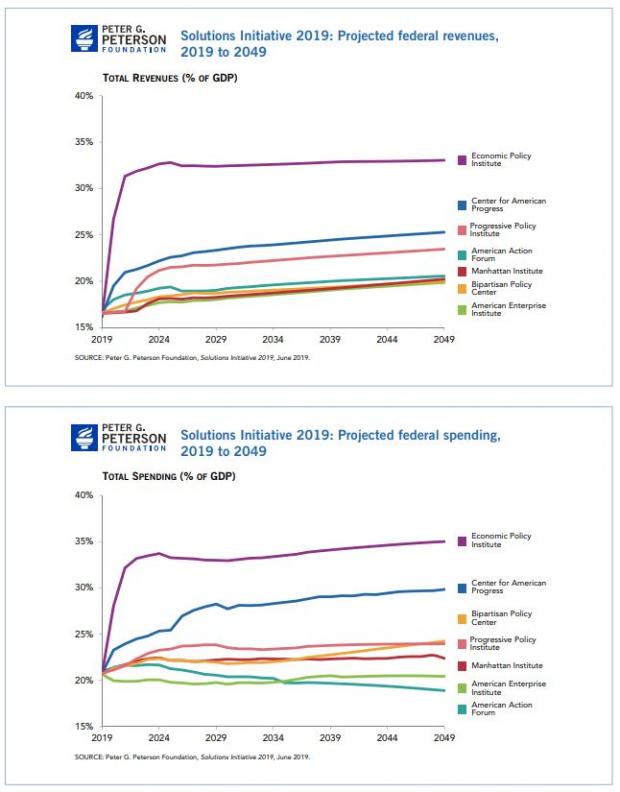

Tackling the $22 trillion national debt can be done in very different ways. Underscoring that point, the Peter G. Peterson Foundation, a non-profit, non-partisan organization focused on increasing awareness of America’s fiscal outlook, asked seven think tanks from across the ideological spectrum to develop 30-year budget plans that both satisfied the groups’ various policy agendas and improved the country’s debt picture.

The plans were released Tuesday as part of the Peterson Foundation’s annual Fiscal Summit in Washington, D.C.

(The Fiscal Times is an editorially independent site founded and funded by Peter G. Peterson and his family.)

The seven policy groups proposing plans were the American Action Forum, the American Enterprise Institute, the Bipartisan Policy Center, the Center for American Progress, the Economic Policy Institute, the Manhattan Institute and the Progressive Policy Institute. The revenue projections in their plans were scored by the Tax Policy Center and the spending effects were reviewed by a former Congressional Budget Office official.

All of the plans rein in the projected growth of the debt to a greater or lesser degree, but they present profoundly different views of how big the government should be and how it should tax and spend.

On health care, the three think tanks on the right (AAF, AEI and the Manhattan Institute) propose to convert Medicare to a “premium support” model in which seniors would get subsidies to buy private insurance. They also propose setting limits on Medicaid payments or otherwise limiting federal Medicaid spending through increased competition. The think tanks on the left would expand coverage under Medicare or similar programs and, in some cases, allow the government to negotiate for lower drug prices.

On Social Security, the proposals range from raising the retirement age and limiting benefits in various ways to expanding benefits and coverage and increasing taxes to pay for those changes. Five of the seven think tanks propose some reduction in retirement benefits. Four of the seven think tanks call for increasing or eliminating the payroll tax cap, and four of the groups call for raising payroll taxes. Overall, six of the seven groups (with AEI being the exception) would raise Social Security revenues as part of their reforms.

On taxes, five of the seven groups would increase individual rates above where the 2017 cuts put them. And four of the seven would raise the corporate tax rate from the 21% set by the Tax Cuts and Jobs Act to between 25% and 35%. Five of the groups would introduce a carbon tax of some sort.

The bottom line: The seven plans are detailed and nuanced, and a few lines of summary here can’t do them justice. To read the plans or watch each group’s summary video, go here.