The Federal Reserve cut its benchmark interest rate for the first time since 2008 on Wednesday, lowering the target for its overnight lending rate by a quarter point, to between 2% and 2.25%, in an effort to protect the U.S. economy against rising risks, including those from President Trump’s trade war.

The rate-setting Federal Open Markets Committee said in its statement that the job market remains strong and that economic growth is likely to continue, but uncertainties cloud the outlook. “Although growth of household spending has picked up from earlier in the year, growth of business fixed investment has been soft,” it said.

Fed Chair Jerome Powell added that the cut, a reversal of a December rate increase, wasn’t “the beginning of a lengthy cutting cycle" — a stance that sent stocks falling. Wall Street has been pricing in multiple rate cuts this year, and President Trump had repeatedly criticized the Fed and called for larger rate cuts.

What It Means for the National Debt

The cut is another signal that interest rates will remain lower than the Congressional Budget Office projects. But the Committee for a Responsible Federal Budget warned Wednesday that even with low rates, the debt is still projected to grow as a share of the economy:

“If interest rates stay at the low levels experienced in early 2019, primary deficits” — that is, before interest costs are factored in — “would still need to be cut from 1.7 percent of GDP to 1.0 percent, the equivalent of $1.8 trillion in spending cuts or tax increases over the next ten years. Putting debt on a clear downward path under this scenario would require reducing primary deficits to about 0.5 percent of GDP, the equivalent of $3.1 trillion of spending cuts or tax increases.” Those CRFB projections don’t account for the cost of extending Congress’ recent tax cuts and spending increases.

For some additional context, CBO has projected that the 2017 tax cuts will add $1.8 trillion to primary deficits through 2028, while CRFB says the recent budget agreement will add $1.7 trillion to projected spending over the next 10 years.

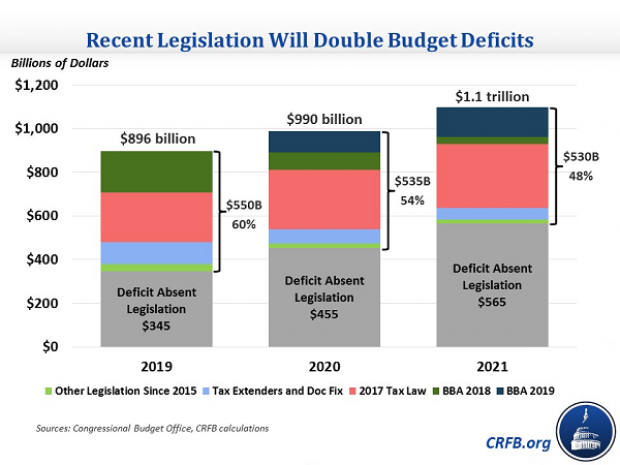

CRFB also says that the tax cuts and spending hikes enacted since 2015 will more than double the deficit in 2020 and 2021. The 2017 tax law accounts for the largest part of that increase, with an expected cost of $565 billion over the next two years, or more than a quarter of projected deficits. The two-year budget deal lawmakers and the White House just agreed to will cost about $235 billion over the next two years.

In all, recent legislation will add about $4.5 trillion to deficits over the next decade, or 35% of a projected total of $13.1 trillion.