The latest entry in the American Enterprise Institute’s ongoing blog series examining the Tax Cuts and Jobs Act comes from Jason Furman, the former chairman of the White House Council of Economic Advisers under President Obama.

Furman says the data since the legislation took effect suggest that tax cuts haven’t had much of an effect on business investment and economic growth:

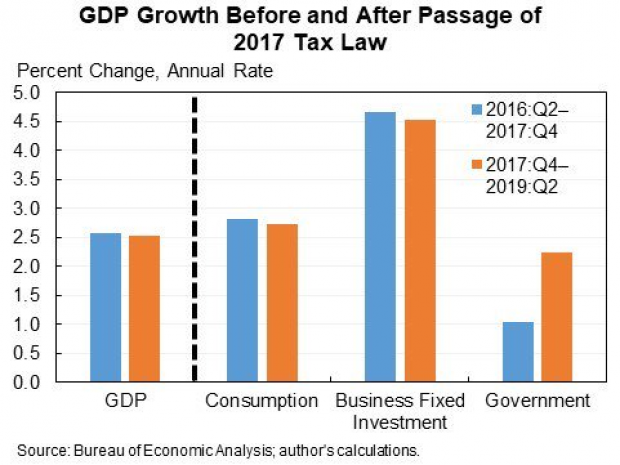

“The TCJA does not appear to have had nearly as much impact as many of its biggest cheerleaders expected and thought they saw in the data in the initial months after it passed. We now have six quarters of data since the law passed, and gross domestic product (GDP) has grown at an annualized rate of 2.5 percent in that period. That is a slight slowdown from the 2.6 percent annual rate in the six quarters leading up to the law’s passage, as shown in the chart below.”

Examining the numbers in finer detail, Furman argues that the tax cuts may have had modestly positive effects on growth in some sectors – but President Trump’s trade war and the Fed’s money tightening policy probably canceled those out.

At the same time, Furman reminds us that virtually “all nonpartisan forecasters in academia, investment banks, and the public sector” projected relatively modest effects from the tax cut legislation, with changes in the country’s growth trajectory that would be hard to detect with any certainty. Furman’s own projections pointed to an increase in the real GDP growth rate of 0.04% per year after 10 years – “a change that would be difficult to detect amid noise and other factors.”

Ultimately, Furman agrees with the authors of the TCJA that the U.S. needs a more efficient tax code. The TCJA took some steps toward that goal, by limiting deductions and expanding expensing, but more could be done along those lines. And other enacted changes, such as lowering the corporate tax rate to 21%, may need to be undone. “Together,” Furman says, “you could call this tax reform or even repeal and replace.”