Elizabeth Warren on Friday detailed how she intends to pay for Medicare for All without raising costs for middle-class households. The senator from Massachusetts said her plan will cover everyone in the country without raising overall spending, “while putting $11 trillion back in the pockets of the American people by eliminating premiums and virtually eliminating out-of-pocket costs.”

Warren’s plan relies in large part on redirecting existing spending toward a universal, federal health care system, while adding new revenues from taxes on the wealthy, the financial sector and large corporations. “We can generate almost half of what we need to cover Medicare for All just by asking employers to pay slightly less than what they are projected to pay today, and through existing taxes,” Warren said.

Some key details from the Warren plan:

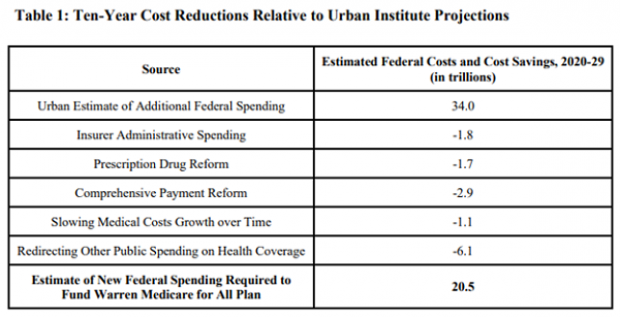

Much lower cost estimate: Warren starts with the Urban Institute’s estimate that the federal government would need $34 trillion more over 10 years to pay for Medicare for All, but she slices that number dramatically — down to $20.5 trillion — by using existing federal and state spending on programs including Medicaid to fund a portion of her proposal, along with larger assumed savings produced by a streamlined system paying lower rates to hospitals, doctors and other health care providers.

Total health care spending stays about the same: Warren projects about $52 trillion in national health care spending over 10 years, close to estimates for the existing system, despite covering more people and offering more generous benefits, including long-term care, audio, vision and dental benefits. Applying Medicare payment levels across the health care system is projected to produce substantial savings that would be used to finance the expanded size and scope of the plan.

Heavy reliance on employer funding: The employer contribution to Medicare for All is pegged at $8.8 trillion, with employers required to contribute to the federal government 98% of what they would pay in employee premiums. Businesses with fewer than 50 employees would be exempt.

Public spending continues: State and local governments would be still on the hook for the $6 trillion they currently spend on Medicaid, the Children's Health Insurance Program and public employee premiums.

New taxes on the wealthy: Warren proposes a new 3% tax on household wealth over $1 billion — and that’s on top of her proposed wealth tax, which calls for a separate 3% tax on wealth over $1 billion (and a 2% tax on wealth between $50 million and $1 billion). Combined with an annual capital gains tax on the top 1% of households, her proposal projects that the new health-care-focused wealth taxes would produce $3 trillion.

Taxes on business and finance: Warren says she can raise $3.8 trillion through “targeted” taxes on big business and financial transactions, including a financial transaction tax of .01% on the sale of stocks, bonds and derivatives.

Reduced tax evasion: Cracking down on tax evasion is projected to bring in $2.3 trillion. “The federal government has a nearly 15% ‘tax gap’ between what it collects in taxes what is actually owed because of systematic under-enforcement of our tax laws, tax evasion, and fraud,” Warren said. “By investing in stronger enforcement and adopting best practices on tax reporting, withholding, and filing, experts predict that we can close the tax gap by a third.”

Revenue increase from higher take-home pay: Employees would no longer pay premiums for health insurance, providing a pay hike and higher tax revenues, estimated to total $1.4 trillion.

Abolishing the Overseas Contingency Operations fund: Warren is calling for reduced military spending, with a focus on what some call the “slush fund” that covers the cost of overseas military operations. Eliminating this off-budget spending is projected to save $800 billion.

Immigration reform: Expanded legal immigration would bring in $400 billion in revenue as more incomes are subject to taxes, Warren says.

A record tax cut? Once the new revenues and cost savings are added up, Warren says her plan will deliver what amounts to an historic tax cut. “No middle class tax increases. $11 trillion in household expenses back in the pockets of American families. That’s substantially larger than the largest tax cut in American history.”

Warren won plaudits from some analysts and policy wonks for releasing a plan, but the details she laid out are also being picked apart by critics and rivals, with some experts already expressing doubts about her assumptions and numbers. Here’s some of the reaction:

Congratulations from a conservative: “Kudos to Senator Warren for actually releasing a plan,” said Scott Greenberg, formerly an analyst with the right-leaning Tax Foundation. “There are a lot of things in here that will draw attacks from the left and from the right, and it might have been politically easier not to release it at all. But Warren has stuck by her commitment to explain her proposals.”

Criticism from a key rival: “The mathematical gymnastics in this plan are all geared towards hiding a simple truth from voters: it's impossible to pay for Medicare for All without middle class tax increases," said Kate Bedingfield, deputy campaign manager for Joe Biden. Bedingfield argued that employees would end up paying the tax on employers.

Dire warnings from the White House: “It is the middle class who would have to pay the extra $100 billion or more to finance this kind of socialist government takeover of health care,” said Larry Kudlow, President Trump’s top economic adviser. “It would have a catastrophic effect on the economy and all these numbers that we're seeing, all these numbers, on incomes per household, on wage increases, on jobs, all these numbers would literally evaporate and by the by, so would the stock market.”

Tax vs. premium: Warren’s plan will likely kick off a debate about the difference between taxes and health care premiums, and whether that difference matters, says William Gale of the Brookings Institution. “Does [the Warren plan] raise ‘taxes’ on the middle class?,” Gale asked Friday. “Short answer -- it does not raise ‘burdens’ on the middle class.”

Cost reduction is crucial: “The key to Warren's plan for financing Medicare for all is aggressively constraining prices paid to hospitals, physicians, and drug companies. We'd still have the most expensive health system in the world, but it would be less expensive than it is now,” said Larry Levitt of the Kaiser Family Foundation. “Warren's plan to aggressively constrain health care prices under Medicare for all would be quite disruptive. On the other hand, every other developed country has managed to figure it out, so we know it's possible.”

And the battle is ultimately political: “In laying out the specifics of her Medicare for all plan, Warren's challenge is more about politics than arithmetic,” Levitt continued. “She is taking on the wealthy, corporations, and pretty much every part of the health care and insurance industries. Those are some powerful enemies.”

So don’t expect major legislation soon: “Experts will argue for months whether [Warren is] being too optimistic — whether her cost estimates are too low and her revenue estimates too high, whether we can really do this without middle-class tax hikes,” said economist Paul Krugman. “You might say that time will tell, but it probably won’t: Even if Warren becomes president, and Dems take the Senate too, it’s very unlikely that Medicare for all will happen any time soon.”