“The IRS touches more Americans than any other entity, public or private,” Internal Revenue Service Commissioner Chuck Rettig said in the agency’s annual report released Monday.

The document provides a summary of IRS operations in the previous fiscal year and an update on the status of the agency’s long-term strategic plan.

Ahead of this year's tax-filing season, which the agency just said will start January 27, here are some highlights from the new 41-page report:

- The IRS processed 255 million tax returns and forms in fiscal year 2019.

- Gross tax receipts came to roughly $3.6 trillion, about 96% of the country’s revenues.

- The average refund was $2,800.

- Enforcement revenue totaled $57.5 billion.

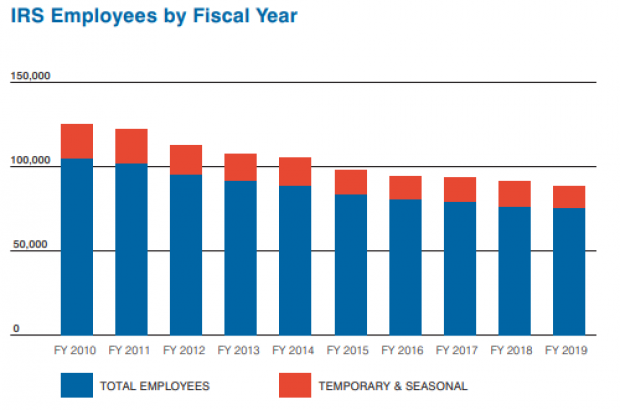

- Employment at the IRS grew by 1,593 full-time positions, for a total of 78,004 in 2019 (that number includes 12,600 temporary and seasonal workers).

- Over the last 10 years, however, the IRS has lost nearly 30,000 full-time positions — and those losses "directly correlate with a steady decline in the number of individual audits during the past nine years," the report says. The situation could get worse over the next five years as nearly 20,000 employees — 31% of the workforce — retire, “creating a significant risk of a large knowledge and experience gap for the nation’s tax agency.”