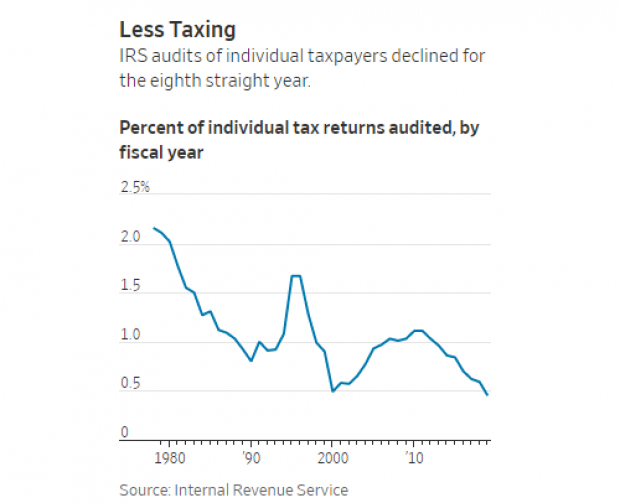

The annual IRS report we told you about yesterday revealed that the agency audited just 0.45% of individual tax returns in 2019. That marks the eighth year in a row the audit rate has dropped, says Richard Rubin of The Wall Street Journal, and the lowest level in at least 40 years.

Many tax experts agree that the IRS needs to beef up its enforcement efforts. “The audit rate reported for 2019 was less than half of what it was in 2010, underscoring the depleted state of the IRS enforcement function, which urgently needs to be rebuilt,” Chuck Marr of the Center on Budget and Policy Priorities told Rubin.

Spending more on enforcement makes sense financially. As former Treasury Secretary Lawrence Summers and University of Pennsylvania law school professor Natasha Sarin recently argued, every $1 invested in auditing, technology and increased reporting would produce as much as $11 in revenue. (The government’s estimate puts that number closer to $4.) Summers and Sarin proposed a $100 billion increase in IRS enforcement spending, which they said would generate roughly $1 trillion over a decade.

But Congress spent years cutting the IRS budget, starting with the Republican-led push for fiscal austerity following the financial crisis, Rubin says. Some critics say the reduction in funding — which has reduced the IRS workforce by 30,000 since 2010 — amounts to a hidden tax cut. “There are direct & indirect ways to cut taxes,” says Jared Bernstein, a senior fellow at the Center on Budget and Policy Priorities. “Starving the IRS of the funds it needs to enforce the code is among the most pernicious indirect ways, one that leaves billions of owed taxes on the table.”

Richard Phillips, a tax analyst for Senate Budget Committee Democrats, said the decline in IRS enforcement helps at least one group. “Make no mistake,” Phillips tweeted Tuesday, “the primary beneficiaries of this policy shift are wealthy tax cheats.”