The IRS doesn’t have enough funding or personnel to do its job properly, according to the 2019 annual report from the Taxpayer Advocate Service, an independent organization within the Internal Revenue Service that assists taxpayers and recommends changes to improve the system.

In the first report released since long-serving leader Nina Olson stepped down, Acting National Taxpayer Advocate Bridget Roberts said that the agency is struggling to accomplish its stated mission: to provide “America's taxpayers top quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all."

Referring to money spent on the IRS as an “extraordinary investment,” Roberts laid out the economic argument for providing more resources to the tax agency:

“In FY 2018, the IRS collected nearly $3.5 trillion on a budget of about $11.43 billion, producing a remarkable ROI of more than 300:1. It is economically irrational to underfund the IRS. If a company’s accounts receivable department could generate an ROI of 300:1 and the chief executive officer (CEO) failed to provide enough funding for it to do so, the CEO would be fired.”

One problem, Roberts went on to say, is that federal budget rules do not take ROI of government spending into account, making it difficult to show the value of increased funding for the agency.

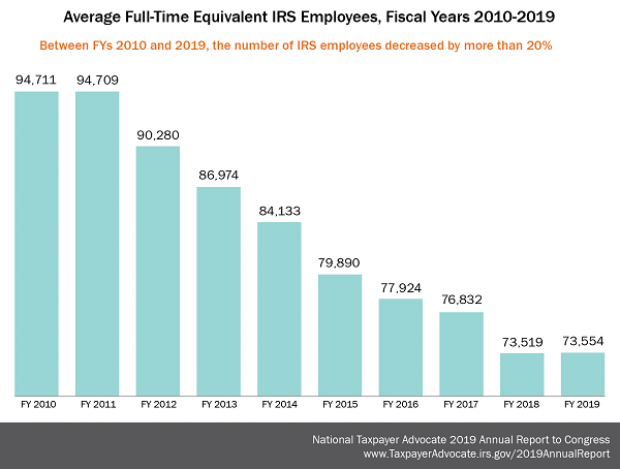

A big drop in employees: Adjusted for inflation, the IRS budget has been reduced by about 20% since 2010, and the number of employees has fallen by about 22%. “The IRS receives approximately 100 million telephone calls every year, and to provide ‘top quality service,’ as its mission statement commits it to do, it requires adequate funding to hire enough employees to answer those calls,” Roberts said.

A $3,000 surtax on taxpayers? Based on an estimated tax gap of $381 billion per year – the difference between what is owed and what is collected – the report says that U.S. households are effectively paying a $3,000 surtax each to cover the lost revenues of those who don’t pay all they owe. The estimate, which assumes the IRS is seeking to collect a fixed amount of revenue while assigning all uncollected funds to those who do pay, is a bit shaky, but it highlights to high price imposed by the failure to invest sufficiently in collection and enforcement efforts.

Plenty of other problems: Roberts cited a litany of issues at the tax agency, including:

- Obsolete technology: “The two IRS systems containing the official records of individual and business taxpayer accounts are the oldest major technology systems in the federal government. The IRS also has about 60 case management systems that generally are not interconnected; each function’s employees must transcribe or import information from other electronic systems and mail or fax it to other functions. Obsolete IT systems limit the functionality of online taxpayer accounts, prevent taxpayers from obtaining full details about the status of their cases, and prevent the IRS from selecting the best cases for compliance actions.”

- Free File flop: The free tax filing program is supposed to cover about 70% of individual taxpayers, but less than 2% actually use it. Based on several reviews of the program, “the National Taxpayer Advocate believes that the current program is not promoting the best interests of taxpayers,” Roberts said.

- A lack of permanent leadership: Roberts, who is serving as a temporary leader, said that “the Office of the Taxpayer Advocate – and taxpayers – deserve a permanent appointee ... Given the current crossroads at which the IRS finds itself, it is critical that a permanent National Taxpayer Advocate be appointed as quickly as possible to help ensure the IRS protects taxpayer rights and meets its obligations to taxpayers.”

A long list of recommended improvements: In a separate “Purple Book,” the National Taxpayer Advocate listed 58 recommendations for improving the IRS. Some highlights, with links to more complete discussions:

- Provide the IRS With Sufficient Funding to Meet Taxpayer Needs and Improve Federal Tax Compliance (pdf)

- Codify the Taxpayer Bill of Rights, a Taxpayer Rights Training Requirement, and the IRS Mission Statement as Section 1 of the Internal Revenue Code (pdf)

- Require the IRS to Provide Taxpayers with a “Receipt” Showing How Their Tax Dollars Are Being Spent (pdf)

- Authorize the IRS to Establish Minimum Competency Standards for Federal Tax Return Preparers (pdf)

- Protect Retirement Funds From IRS Levies, Including So-Called “Voluntary” Levies, in the Absence Of “Flagrant Conduct” by a Taxpayer (pdf).