The coronavirus pandemic continues to crush the labor market, as more than 4.4 million Americans filed new claims for jobless benefits last week, according to seasonally adjusted data released by the government on Thursday.

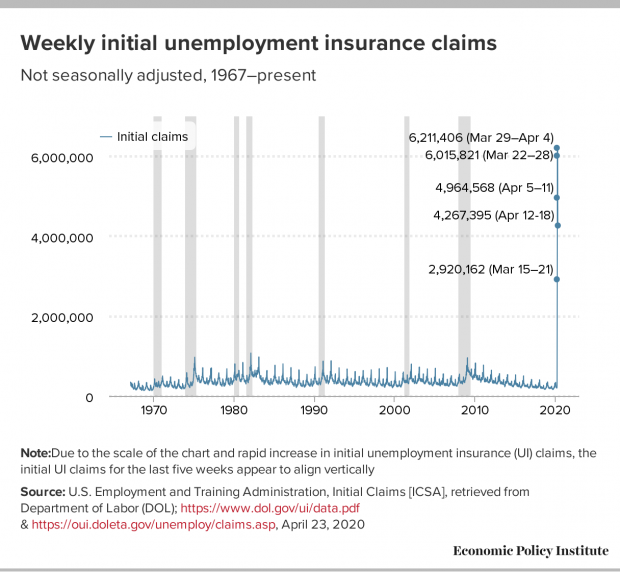

The latest report, which covers the week ending April 18, brings the total number of jobs lost over the past five weeks to 26.4 million, more than were added in the years since the Great Recession. Even without the Labor Department’s adjustments to even out seasonal changes, 24.4 million workers applied for benefits over the five-week span. Nearly one in six American workers has lost a job in the coronavirus shutdown.

“For comparison, in the period before the coronavirus hit, just over a million workers would apply for UI in a typical five-week span, and in the worst five-week stretch of the Great Recession, it was less than four million,” Heidi Shierholz of the Economic Policy Institute says.

A slow downward trend: The latest figures represent a decline from the previous three weeks. “A bit less awful,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a note. “Another horrendous number, but at least the trajectory is clearly downwards.”

Shepherdson expects claims to decline again next week, but notes that the pace of “file for unemployment” searches on Google means that it may still be several more weeks before new filings drop below 1 million — a level that would still be far higher than the 665,000 claims filed in the single worst week after the 2008 financial crisis.

These numbers still understate the true toll: Millions of workers affected by the pandemic still haven’t been able to apply for unemployment benefits.

An unemployment rate approaching 20%: Economists expect the unemployment rate for April will climb to between 15% and 20%, or possibly even higher. “All else equal, job losses of this magnitude would translate into an unemployment rate of 18.3%,” Shierholz writes. “However, the official unemployment rate, when it is released, will likely not reflect all coronavirus-related layoffs. This is due to the fact that jobless workers are only counted as unemployed if they are actively seeking work. That means many workers who lose their job as a result of the virus will be counted as dropping out of the labor force instead of as unemployed, because they are unable to search for work due to the lockdown.”

The squeeze on state budgets: A new analysis by researchers at the Urban Institute estimates that an unemployment rate averaging 12% over one year would mean a $340 billion revenue decline for states and a $385 billion shortfall in state budgets, even without factoring in the direct pandemic-related costs states face. “Medicaid enrollment will grow at the same time that tax revenues are falling, putting the squeeze on state budgets,” said Kathy Hempstead, senior policy adviser at the Robert Wood Johnson Foundation. The researchers say that increasing the federal matching rate for Medicaid and the Children's Health Insurance Program would ease fiscal pressure on states, and that linking that financial support for health programs to unemployment rates would increase health coverage and give states greater budgetary certainty.