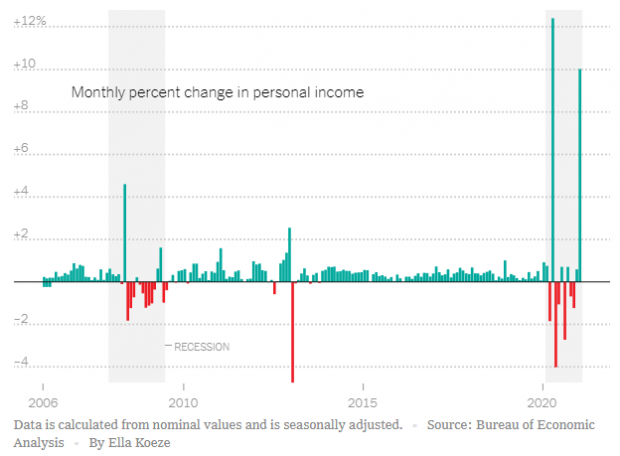

In another sign of economic recovery, personal income jumped 10% in January, lifted by $600 government coronavirus relief payments and enhanced unemployment benefits, the Commerce Department said Friday. The monthly increase was the largest since April and followed a 0.6% increase in December and decreases in the previous two months (see the New York Times chart below).

The “stimulus checks” helped fuel a surge in retail sales as personal consumption expenditures rose by 2.4% for the month, just below analyst estimates of 2.5%. The personal savings rate — or savings as a percentage of disposable income — also jumped to 20.5% as Americans socked away some $3.9 trillion, the government said. Inflation, meanwhile, remained tame, at 1.5% year over year.

Why it matters: “The January data was the latest sign of the economy’s march forward, a trend also seen in recent reports on retail sales and orders of durable goods,” the Times reports. “Some economists are now predicting not just a period of growth after the pandemic, but perhaps even a post-Covid boom.” That boom, economists expect, will be unleashed once the health crisis has largely passed as consumers start spending the money they’ve saved up over the many months of the pandemic.

But the data also suggest that the recovery remains dependent on government support, Diane Swonk, chief economist for the accounting firm Grant Thornton told the Times: “Technically, you could say we’re recovering,” she said. “But the patterns in both income and spending point out the fragility of the recovery without aid to bridge these waters that are poisonous.”