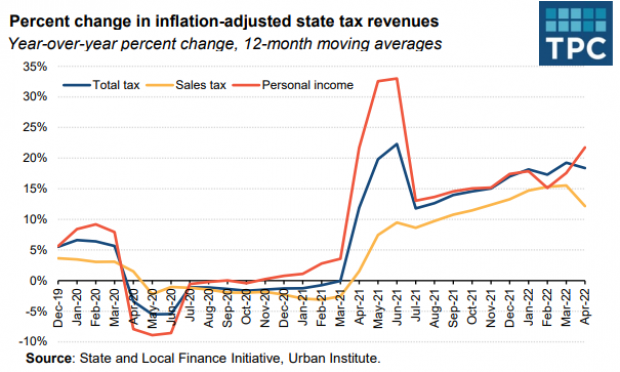

State sales tax revenues may be flashing a warning sign for the economy: 26 states saw inflation-adjusted collections of sales taxes fall in April 2022 compared to April 2021, according to report from the Urban-Brookings Tax Policy Center. Total state sales tax collections, adjusted for inflation, fell 1.2% year over year.

State coffers are still flush, with total tax revenues up 13% over the first 10 months of the fiscal year, including a 14.9% increase in personal income taxes and a 32.6% rise in corporate income taxes. Of 46 states for which preliminary data were available, 45 saw total tax revenues grow compared to the prior year, with 15 states reporting growth of more than 15%.

Still, the report warns that the recent revenue surge may be coming to an end: “The strong growth in state tax revenues is unlikely to continue and evidence is growing that the strong revenue growth experienced this fiscal year is likely tempering or even reversing.” It adds that sales tax revenues are expected to weaken as inflation affects consumer behavior and shoppers revert to pre-pandemic spending patterns: “Over time, especially if wages and income do not keep up with inflation, we expect consumers to continue to adjust their spending patterns which will negatively affect state sales tax revenues.”

Many states are preparing for a fiscal downturn, Bloomberg’s Donna Borak reports. “Thirty-seven states plan to maintain or increase their rainy day fund balances in 2023 as they brace for a slowdown, according to the latest quarterly fiscal survey from the National Association of State Budget Officers, released June 16.” But the changing economic landscape may still leave some states struggling. “Unfortunately, many states have just been thinking in the short term and have enacted tax cuts, mostly for income tax, and now, the impact of the tax cuts combined with the new reality and the end of the federal aid will put states in a really tough position,” Lucy Dadayan, a senior research associate at the Urban-Brookings Tax Policy Center and author of the state tax report, told Bloomberg. “They will have to look for different alternatives for raising revenues.”