Does the U.S. government have a spending problem or a revenue problem? Republicans insist that rising deficits and debt and are caused by the former, while Democrats have argued that repeated tax cuts have undermined the fiscal outlook.

It’s a debate you’re likely to hear often in the coming months, but a new analysis by the non-partisan Committee for Responsible Federal Budget, which advocates for deficit reduction, says that — shocker! — both lower taxes and higher spending are to blame for the rise in debt since 2001.

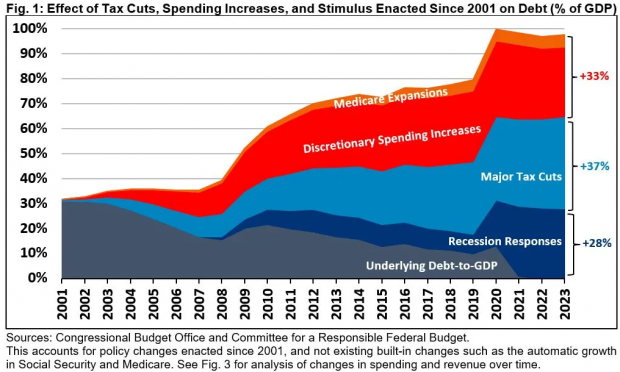

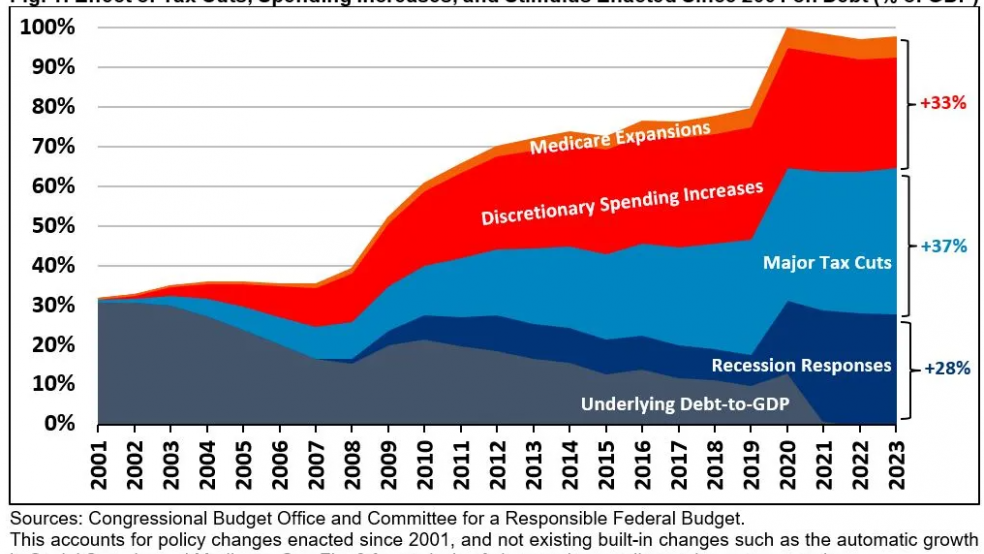

If not for policy changes enacted over the last 22 years, the debt would be fully paid off, CRFB says. “Debt is 37 percent of GDP higher due to major tax cuts, 33 percent higher due to major spending increases, and 28 percent higher due to recession responses,” the report says, noting that most debt can be attributed to bipartisan legislation.

Five major tax bills have cost more than $8 trillion through last year, and lawmakers enacted nearly $6 trillion in net spending increases. Responses to the Great Recession and the Covid-19 pandemic added another $6.8 trillion in costs.

The study also looks at how spending and revenue have changed as a share of the economy since 2001. It finds that rising spending, primarily in mandatory programs, accounts for about two-thirds of the growth in annual deficits, while declining revenue explains one-third. “Had revenue remained stable as a share of the economy, the debt would be half its size; had primary spending been stable, it would be nearly paid off,” the report says.

The bottom line: CRFB says that whether spending is too high or revenue is too low “is a question of values and priorities that cannot be answered objectively.” But it says that improving the nation’s fiscal outlook can’t rely on just higher taxes or slower spending. “Any realistic plan to fix the debt will require addressing both revenue and spending,” CRFB says.