There has been a slew of positive economic signs in 2014. Stocks continue to soar to record highs. Jobs are being created at the best pace since the 1990s. GDP grew last quarter at a blazing 4.2 percent pace. Even food stamp usage has begun falling after years and years of going in the other direction. Corporate profits are at all-time highs.

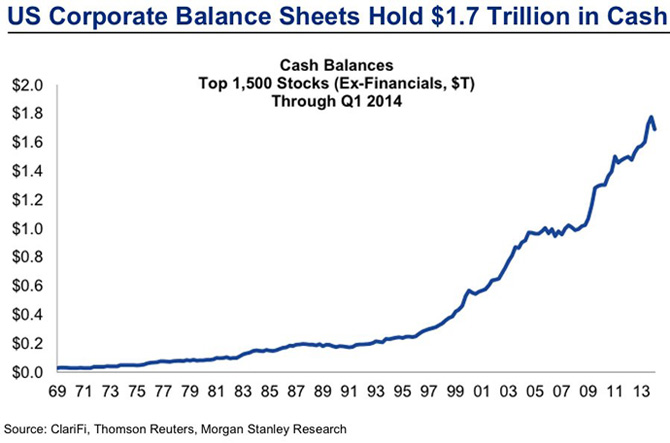

But the one big piece missing from the puzzle (alongside wage growth, which is still relatively lackluster) was capital expenditure. U.S. firms were sitting on huge piles of cash, and after 2011 they stopped investing it in the way you would expect to see during an economic recovery.

Related: Gun Tourism in U.S. Is Booming

Yet at long last, as Sam Ro of Business Insider points out — and as I predicted earlier this month — that is changing. American firms' massive reservoir of cash is shrinking:

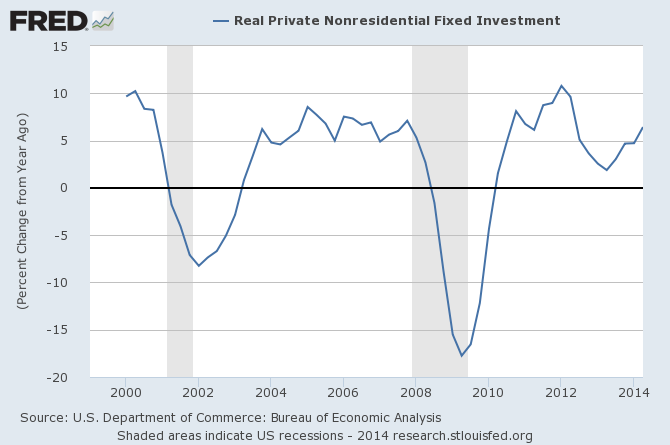

And money is pouring into business investment:

This was inevitable, mainly because America's factories, infrastructure, and equipment are the oldest they have been since the Great Depression. Crumbling equipment and premises are bad for business. If firms want to keep up those high profit margins and remain abreast of the competition, they need to replace, repair, or upgrade obsolete and failing equipment and premises.

Related: Why We’re So Down in the Dumps About the Economy

The really exciting thing is that this is a very good indicator of a strengthening economic recovery that includes lower unemployment and higher economic growth. Sitting on cash might give firms a security blanket to insulate themselves against future economic shocks, but it does nothing to benefit the wider economy. It is just idleness.

Investing that cash, on the other hand, encourages a beneficent spiral — as firms invest, they put money in workers' pockets, which increases disposable income, bolsters confidence, and raises demand in the economy. Growing capital expenditure is the best evidence thus far that this is not a bubble, but a real, solid economic expansion. And long may it last.

This article originally appeared in The Week.

Read more at The Week: