Donald Trump.

Just uttering his name will summon a powerful mix of emotions in the average American depending on their political bent. The GOP presidential frontrunner continues to ruffle feathers, crash the status quo — and he remains the only Republican with a path to the nomination on the first ballot at the party’s convention.

Amid Trump’s talk of NATO's obsolesce and building walls, he has also chimed in with some surprisingly contrarian — and in my opinion, right on the money — statements on the economy.

Related: Here’s the Map That Shows Why the GOP Is Freaking Out About Trump

In my last post on The Donald, I laid out the case why his unique brand of economic nationalism is a reflection of long-simmering problems. His latest stunner — warning of an epic recession and stock market crash in comments to The Washington Post — drew a collective gasp from an electorate familiar with politicians and policymakers talking up the health of the economy and the you-just-can't-lose fantasy of forever levitating share prices. And yet his bombast touches on many profound truths.

First, let's talk about his comment that the 5 percent unemployment rate is likely doctored and that we're "probably into the twenties if you look at the real number."

Trump elaborated on the official unemployment rate, which was just reported in Friday's nonfarm payroll report: "That was a number that was devised, statistically devised to make politicians — and, in particular, presidents — look good. And I wouldn't be getting the kind of massive crowds that I'm getting if the number was a real number."

Related: The Brutal Economic Truth Behind the Rise of Trump

Economists at Bank of America Merrill Lynch took a crack at the jobless rate issue in a note to clients on Tuesday, admitting that the situation "doesn't feel" like unemployment is really at 5 percent. Because of the way unemployment is calculated, the rate can be reduced either by more people finding jobs or more people giving up on their job search. Factoring in a partial recovery in the labor force participation rate from levels not seen since the 1970s, the economists estimate the "real" unemployment rate is about 6 percent and potentially as high as 7.7 percent.

That’s still a far cry from Trump’s claim that the real unemployment rate is “into the twenties” — but the broader point remains that Americans are more sensitive to the labor force participation rate, which has been collapsing since the dot-com bubble peaked in the late 1990s.

According to Bank of America Merrill Lynch, some of that that drop is the result of demographics (more workers aged 55-plus and fewer younger workers) and partially by gender (more women and fewer men in the workforce). The rest is harder to pin down, and is likely driven by issues including greater reliance on disability benefits, lost skills and other factors.

Trump's message of economic nationalism could be seen as an answer to this piece of the puzzle, with blame going to free trade agreements, H-1B skilled guest workers and outsourcing of American jobs overseas.

Trump also warned the country is headed for a "very massive recession" — contrary to the forecasts of Wall Street economists, who now say the country has about a 20 percent chance of sliding into a downturn over the next 12 months.

Related: The Unemployment System Can’t Handle Another Recession

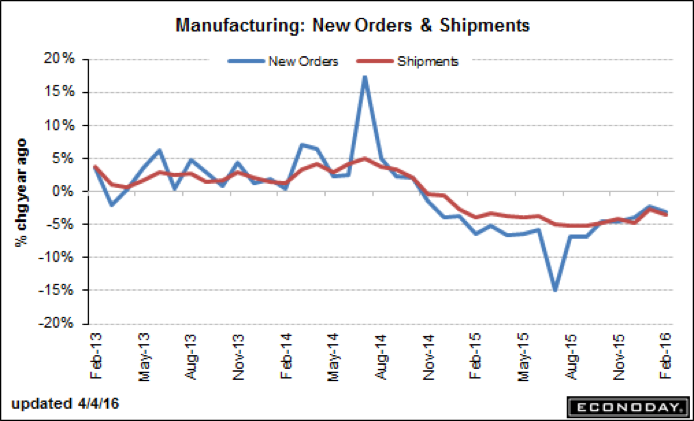

But there is no denying that the current economic expansion is looking old and feeble, with the Atlanta Fed's GDPNow tracking estimate of first-quarter growth recently being cut to just 0.4 percent and Federal Reserve officials admitting that, despite strong job gains, they don't feel confident enough to raise rates again. Factory activity remains tepid, with new orders and shipments on the decline since late 2014.

Finally, Trump warned that it's a "terrible time" to invest in the stock market given his feeling that we’re in the midst of another “financial bubble.” Back in December, he warned the bubble could soon burst.

With core measures of inflation rapidly approaching the Fed's 2 percent target, with the risks of prices surging to the upside should energy prices continue to stabilize, Fed Chair Janet Yellen seems to be coming up with as many excuses as possible for delaying any new rate hike. Futures market estimates put the next policy tightening timing in December, after the election.

Related: Why Interest Rates Could Be Locked in Until 2018

If there was going to be a catalyst to prick this latest bubble — fueled by the grandest experiment in cheap money stimulus in human history — a series of aggressive Fed rate hikes would do the trick.

For now, the technical and fundamental outlook still looks challenging for stocks as the Dow Jones Industrial Average contends with major technical resistance near the 18,000 level. The price-to-sales ratio of U.S. stocks hasn't been higher since the sub-prime bubble burst. Debt-funded corporate stock buybacks, a major source of buying demand for equities, look vulnerable now that buybacks as a percentage of operating income have reached a record high. Net debt-to-equity ratios have jumped their historic range as balance sheet leverage amps up.

The first-quarter earnings season starts next week, with analysts looking for S&P 500 earnings to decline 8.5 percent over last year — on track for the fourth consecutive quarter of falling profitability. Corporate profits peaked in the second quarter of 2015. Recessions typically start five to seven quarters later.

Strategists from J.P. Morgan have warned clients to brace for the end of the seven-year bull market: "This is not the stage of the U.S. cycle when one should be buying stocks with a six- to 12-month horizon. We recommend using any strength as a selling opportunity."

Trump, it seems, could be onto something. Which makes one wonder why he wants the job — cleaning up what's likely to be one hell of a socio-economic mess — in the first place.