4 Reasons the Fed Won’t Raise Interest Rates in June

It is no surprise that the Fed didn’t take action on interest rates at the April Federal Open Market Committee meeting. The question of interest to the market is whether the Federal Reserve has revealed some clear signal in its statement about the timing of the future rate increase. Even though the Fed did not change its forward guidance on rate increases from the March statement, we can discern what the Fed has on its plate. Four aspects of the economy stand out:

Related: Bernanke Was Right—Interest Rates Aren’t Going Anywhere

- The latest GDP data show worse-than-expected growth at an annualized 0.2 percent during the first quarter of 2015, compared to 2.2 percent in the last quarter of 2014.

- The strong U.S. dollar has continued to weigh on exports. Net exports in the first quarter stayed unchanged (0.0 percent growth) year-over-year, compared with 18.6 percent growth in the fourth quarter of 2014.

- Inflation has continued to stay way below the central bank’s 2 percent target. The price index for personal consumption expenditure (PCE), the measure of inflation preferred by the Fed, showed a 0.3 percent year-over-year increase in the first quarter, much lower than the growth rate of 1.1 percent in the fourth quarter of last year. Core PCE inflation, which excludes volatile prices of food and energy, reached 1.3 percent, compared with 1.4 percent in the last quarter.

- The improvements in the labor market, the other mandate of the Federal Reserve besides inflation, also slowed. Only 126,000 employees were added to nonfarm payrolls in March, compared to 264,000 in February and 201,000 in January.

Related: Fed’s Downgrade of Economic Outlooks Signals Later Rates Lift-Off

In all, the U.S. economy is growing more slowly than anticipated with some headwinds that may last for a while, such as the strong dollar. Both measures of the Fed’s dual mandate, price stability and maximum employment, remain below the Fed’s target. Normally this would call for an accommodative monetary policy, postponing the rate increases until later in the year. Rather than starting rate increases at the June FOMC meeting, the liftoff in September instead is more likely.

This story originally appeared at the American Institute for Economic Research.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

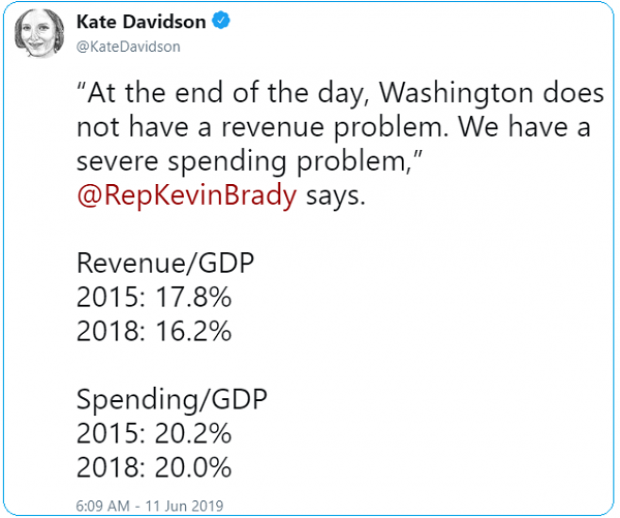

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

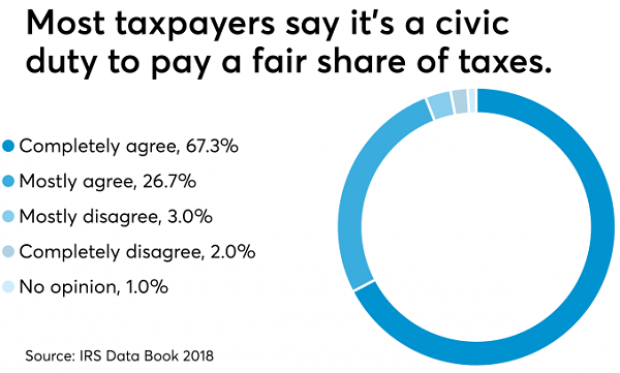

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.