4 Reasons the Fed Won’t Raise Interest Rates in June

It is no surprise that the Fed didn’t take action on interest rates at the April Federal Open Market Committee meeting. The question of interest to the market is whether the Federal Reserve has revealed some clear signal in its statement about the timing of the future rate increase. Even though the Fed did not change its forward guidance on rate increases from the March statement, we can discern what the Fed has on its plate. Four aspects of the economy stand out:

Related: Bernanke Was Right—Interest Rates Aren’t Going Anywhere

- The latest GDP data show worse-than-expected growth at an annualized 0.2 percent during the first quarter of 2015, compared to 2.2 percent in the last quarter of 2014.

- The strong U.S. dollar has continued to weigh on exports. Net exports in the first quarter stayed unchanged (0.0 percent growth) year-over-year, compared with 18.6 percent growth in the fourth quarter of 2014.

- Inflation has continued to stay way below the central bank’s 2 percent target. The price index for personal consumption expenditure (PCE), the measure of inflation preferred by the Fed, showed a 0.3 percent year-over-year increase in the first quarter, much lower than the growth rate of 1.1 percent in the fourth quarter of last year. Core PCE inflation, which excludes volatile prices of food and energy, reached 1.3 percent, compared with 1.4 percent in the last quarter.

- The improvements in the labor market, the other mandate of the Federal Reserve besides inflation, also slowed. Only 126,000 employees were added to nonfarm payrolls in March, compared to 264,000 in February and 201,000 in January.

Related: Fed’s Downgrade of Economic Outlooks Signals Later Rates Lift-Off

In all, the U.S. economy is growing more slowly than anticipated with some headwinds that may last for a while, such as the strong dollar. Both measures of the Fed’s dual mandate, price stability and maximum employment, remain below the Fed’s target. Normally this would call for an accommodative monetary policy, postponing the rate increases until later in the year. Rather than starting rate increases at the June FOMC meeting, the liftoff in September instead is more likely.

This story originally appeared at the American Institute for Economic Research.

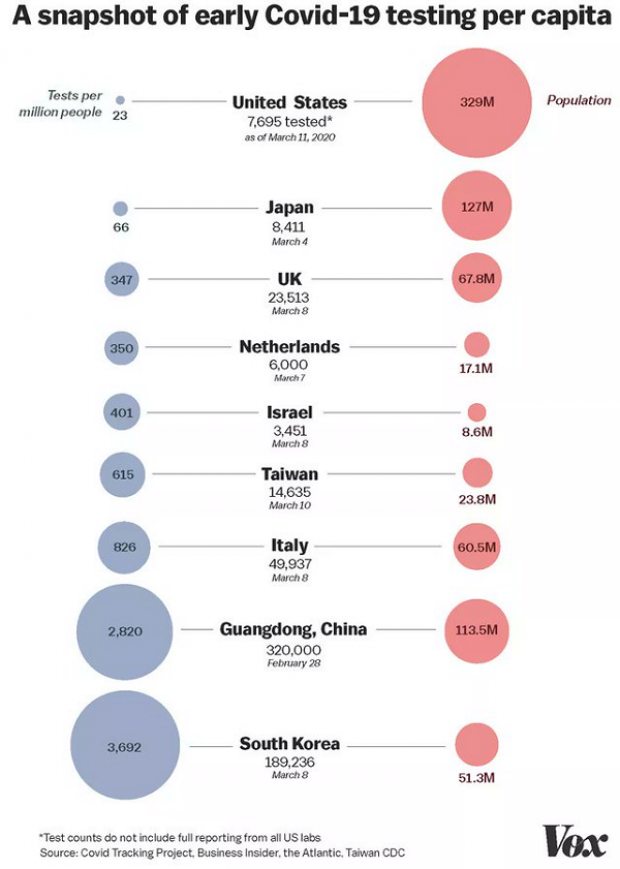

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”