Privacy-Focused DuckDuckGo Search Engine Says Traffic Has Soared Since Snowden Leaks

If you haven’t yet heard about DuckDuckGo, you probably will soon.

On its face, the search engine looks much the same as any other. A little more sparse, maybe, but nothing much separating it from, say, Google. There’s a logo and a box for your search.

Where it differs from its peers, though, is what happens when you hit enter.

Though silly in name, DuckDuckGo has a serious ethos: protection of user privacy at all costs. The engine, launched in 2009, shies away from the personalized filter bubbles so adored by search giants like Google and Bing, refusing to track searches or store user data. Users have the option to completely anonymize their search by routing it through the anonymizing TOR network, rendering it even more invisible to prying eyes. DuckDuckGo earns money through simple keyword-targeted advertising, steering clear of the tracking cookies used by more sophisticated ad campaigns.

Though the slavish dedication to privacy has its drawbacks — for example, results are less tailored to the user searching for them, and thus more likely to be irrelevant — the search engine has seen 3 billion searches a year and has a firm community of fans who are attracted to the site’s long-standing defense of user privacy.

Related: News Companies Have Good Reason to Fear Facebook

That ethos seems to be paying off. Gabe Weinberg, CEO of the Pennsylvania-based company, told CNBC last week that the search engine’s traffic has grown 600 percent since Edward Snowden’s 2013 revelations about the large-scale spying conducted by the government. DuckDuckGo’s search traffic was further assisted last year when Apple integrated it into the Safari mobile browser.

DuckDuckGo’s traffic is still tiny compared to the big players — the 3 billion searches a year that Weinberg claimed to have on CNBC is pretty much the same amount of searches that Google traffics in a single day. But DuckDuckGo expects steady growth as average users become increasingly educated about their privacy.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

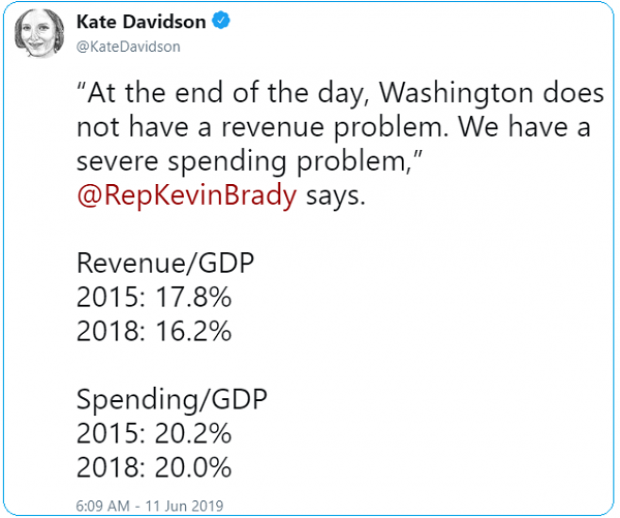

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

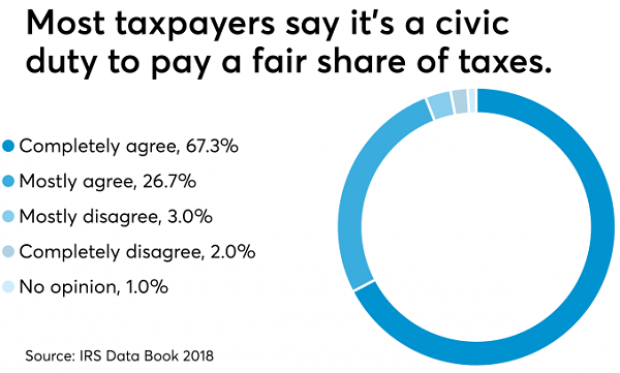

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.