Facebook Hit a Mind-Boggling Milestone This Week

You know what’s cooler than having hundreds of millions of people use your product every day? Having a billion people use it in one day.

That’s what happened for Facebook for the first time on Monday when more than a billion people logged on to the social network, according to a post on CEO Mark Zuckerberg’s page. That’s one in seven people worldwide.

That means that a billion people potentially saw the ads that help generate the revenue that has powered Facebook’s growth. In particular, Facebook has been at the forefront of the shift toward earning ad dollars via online video, the fastest-growing digital advertising category.

Related: Will Facebook Kill the News Media or Save It?

Zuckerberg didn’t mention revenue in his post. Instead, he wrote that he is proud of the community built by the social network and said that connecting the world is making it a better place. “It brings stronger relationships with those you love, a stronger economy with more opportunities, and a stronger society that reflects all of our values.”

The milestone comes as the social network has been moving aggressively to monitor user habits and expand its product offerings to include instant messaging, photo-sharing and now a new virtual assistant. It has also explored moving into the e-wallet space and is reportedly looking into developing a credit rating system based on a user’s network.

While a billion users a day is nothing to scoff at, the company—as always—is dreaming bigger. Last month, Facebook finished construction of a drone that it hopes will provide Internet access to remote parts of the world. That way everyone everywhere can be wished a “Happy Birthday” by 300 people they haven’t spoken to in years.

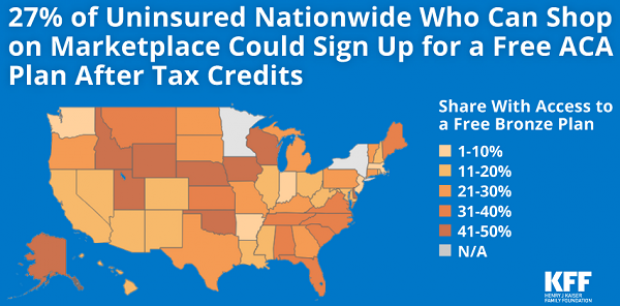

4.2 Million Uninsured People Could Get Free Obamacare Plans

About 4.2 million uninsured people could sign up for a bronze-level Obamacare health plan and pay nothing for it after tax credits are applied, the Kaiser Family Foundation said Tuesday. That means that 27 percent of the country’s 15.9 million uninsured people could get covered for free. The chart below breaks down the eligible population by state.

Takedown of the Day: Ezra Klein on Paul Ryan's Legacy of Debt

Vox’s Ezra Klein says that retiring House Speaker Paul Ryan’s legacy can be summed up in one number: $343 billion. “That’s the increase between the deficit for fiscal year 2015 and fiscal year 2018— that is, the difference between the fiscal year before Ryan became speaker of the House and the fiscal year in which he retired.”

Klein writes that Ryan’s choices while in office — especially the 2017 tax cuts and the $1.3 trillion spending bill he helped pass and the expansion of the earned income tax credit he talked up but never acted on — should be what define his legacy:

“[N]ow, as Ryan prepares to leave Congress, it is clear that his critics were correct and a credulous Washington press corps — including me — that took him at his word was wrong. In the trillions of long-term debt he racked up as speaker, in the anti-poverty proposals he promised but never passed, and in the many lies he told to sell unpopular policies, Ryan proved as much a practitioner of post-truth politics as Donald Trump. …

“Ultimately, Ryan put himself forward as a test of a simple, but important, proposition: Is fiscal responsibility something Republicans believe in or something they simply weaponize against Democrats to win back power so they can pass tax cuts and defense spending? Over the past three years, he provided a clear answer. That is his legacy, and it will haunt his successors.”

Number of the Day: $300 Million

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, wants the agency to be known as the Bureau of Consumer Financial Protection, the name under which it was established by Title X of the 2010 Dodd-Frank Wall Street reform law. Mulvaney even had new signage put up in the lobby of the bureau. But the rebranding could cost the banks and other financial businesses regulated by the bureau more than $300 million, according to an internal agency analysis reported by The Hill’s Sylvan Lane. The costs would arise from having to update internal databases, regulatory filings and disclosure forms with the new name. The rebranding would cost the agency itself between $9 million and $19 million, the analysis estimated. Lane adds that it’s not clear whether Kathy Kraninger, President Trump’s nominee to serve as the bureau’s full-time director, would follow through on Mulvaney’s name change once she is confirmed by the Senate.

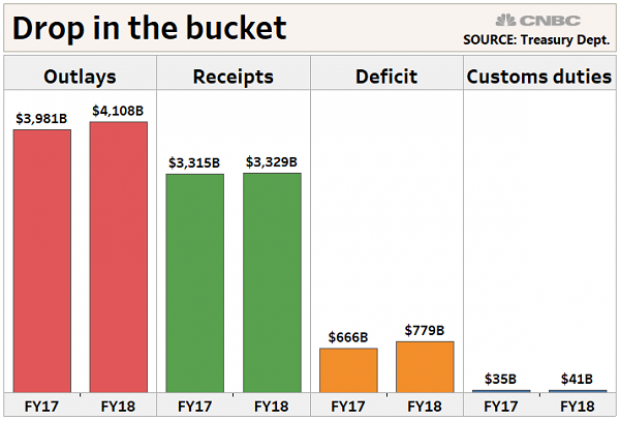

Why Trump's Tariffs Are Just a Drop in the Bucket

President Trump said this week that tariff increases by his administration are producing "billions of dollars" in revenues, thereby improving the country’s fiscal situation. But CNBC’s John Schoen points out that while tariff revenues are indeed higher by several billion dollars this year, the total revenue is a drop in the bucket compared to the sheer size of government outlays and receipts – and the growing annual deficit.

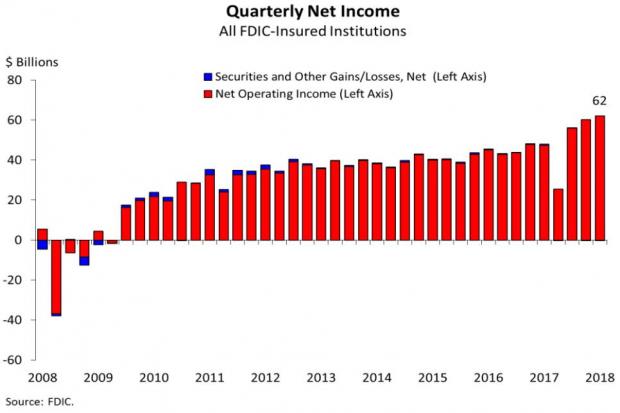

Bank Profits Hit New Record Thanks to 2017 Tax Law

Bank profits reached a record $62 billion in the third quarter, up $14 billion, or 29.3 percent, from the same period last year, according to data from the Federal Deposit Insurance Corporation. The FDIC said that about half of the increase in net income was attributable to last year’s tax cuts. The FDIC estimated that, with the effective tax rates from before the new law, bank profits for the quarter would have risen by about 14 percent, to $54.6 billion.