How CNN Is Cashing In on Trump-Mania

Fox News’s GOP debate last month generated blockbuster ratings — 24 million viewers saw Donald Trump and the other top Republican presidential contenders mix it up, making it the most-watched non-sports cable show ever. Now Fox News rival CNN is poised to cash in on that success.

The news network is asking advertisers to pay 40 times its usual rate, or as much as $200,000 for a 30-second commercial, during the second GOP debate, which it is scheduled to host on Sept. 16, according to Ad Age. CNN is also charging $50,000 to $60,000 for commercials airing that day in the earlier debate between second-tier candidates.

Related: Two New Polls Show Exactly Why Donald Trump Is Winning

Ad Age says CNN isn’t expected to pull in quite the same level of viewership as Fox News did, but even if the next primetime debate fails to match the earlier numbers, it is still likely to be the most-watched debate CNN has ever aired. The network can thank Trump for that, just as it could thank another outspoken and unpredictable GOP phenomenon for helping to set its previous debate record: In 2008, almost 11 million viewers tuned in to the vice presidential debate between Joe Biden and — you betcha! — Sarah Palin.

If the Palin example holds, news networks aren’t going to be the only ones to benefit from the Trump surge. “Saturday Night Live” saw its viewership and buzz soar in 2008 as Tina Fey’s impersonation of Palin became a sensation in its own right. And when the former Alaska governor appeared on SNL in October 2008, the show drew its highest ratings in 14 years.

Related: Trump Is Still Surging — Here’s Who Can Stop Him

The new season of SNL starts Oct. 3, so it’s probably a safe bet that Lorne Michaels — and other executives at NBC, even after the network dumped Trump from The Celebrity Apprentice in the wake of his comments about Mexican immigrants — are rooting for Trump mania to keep going for another month, at least. In the meantime, NBC announced Tuesday that Trump will appear on “The Tonight Show” next week.

Top Reads from The Fiscal Times:

- Doctors to Trump: Deporting Illegal Immigrants Would Be Bad for U.S. Health

- How Much Does Our Social Safety Net Cost? $742 Billion a Year and Rising

- If Clinton Loses Her Security Clearance, Could She Still Be President?

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

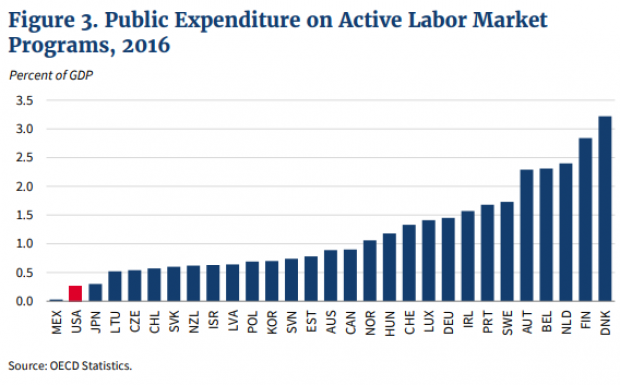

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.