Smart-chip credit cards are so 2015.

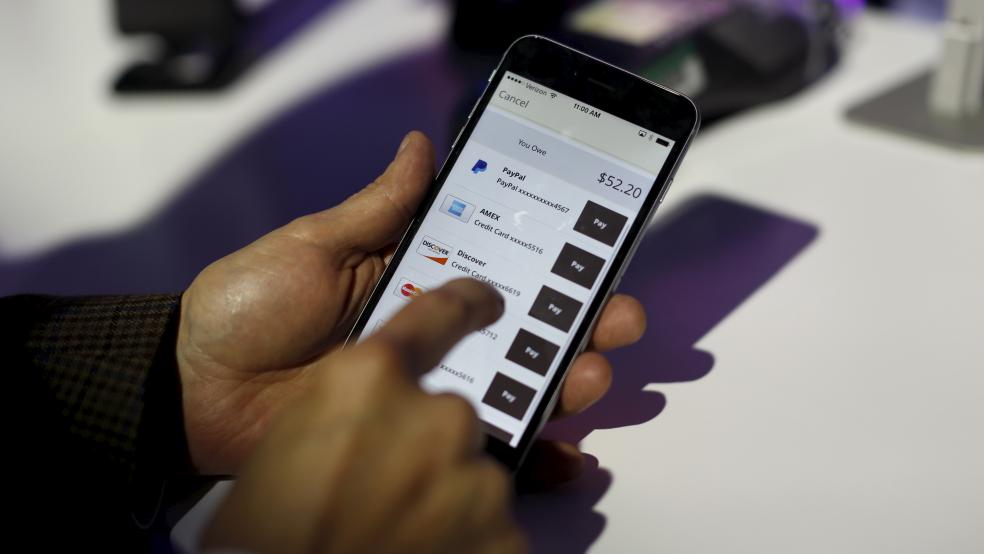

In 2016 and beyond, mobile phones will become the hot new way to pay for goods at retailers, and the number of people who use such technology is set to explode.

U.S. consumers are projected to spend nearly $9 billion buying goods in-store via their smartphones this year, but that number will jump to more than $27 billion the following year, and pass $200 billion by 2019, according to a new report from eMarketer.

The average user will spend about $375 this year via in-store mobile payments, but by 2019, he’ll spend more than $3,000 that way.

Related: 10 Best American Cities for Startups

The growth in use reflects improved virtual wallets from companies like Apple Pay and Google Wallet, and a growing acceptance of them from retailers, who will likely start to incorporate loyalty programs and rewards to entice new users. Retailers are now required by law to have point-of-sale systems that use more secure near-field communication chips (used by smart-chip credit cards), which also allows them to accept payment from many virtual wallets.

One downside for consumers: Paying via mobile wallet may encourage you to spend more. Studies have shown that consumers who pay for purchases with cash consistently spend less money than peers who use credit cards. That’s because it’s easier for your brain to process the cost (and its impact on your bank account) when you’re counting out cold, hard cash and handing it to a cashier rather than quickly swiping a piece of plastic. That effect could be diminished even further when transactions are boiled down to a tap on your phone.