Three quarters of all homeowners believe it’s unlikely they’ll experience a home maintenance emergency in the next 12 months, and many have little or no money set aside to cover such an event, according to a new survey from HomeServe USA.

That belief may be leaving homeowners unprepared for potentially costly and relatively common expenses. The same survey found that more than half of homeowners had experienced an emergency home repair in the past year.

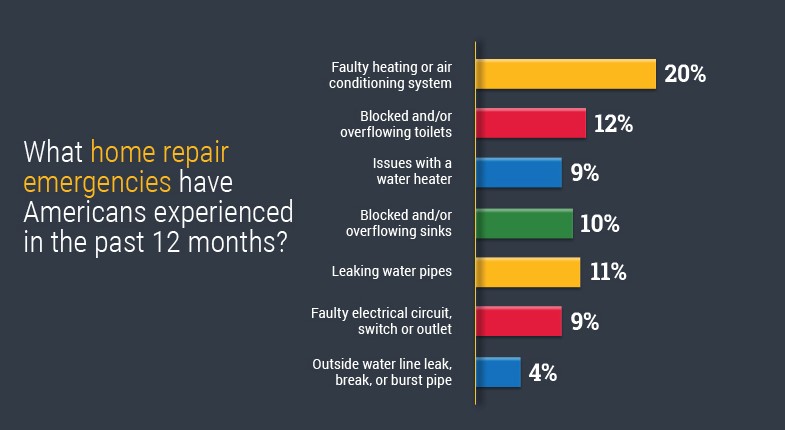

Source: HomeServe USA

The most frequently reported issue, experienced by 20 percent of homeowners, was a faulty heating or air conditioning system, according to the survey. Other common problems included blocked or overflowing toilets (12 percent), leaking water pipes (11 percent) and blocked or overflowing sinks (11 percent).

It costs around $300 to hire an HVAC repairman or a plumber, according to HomeAdvisor, but damage from leaking pipes or an overflowing toilet can easily cost thousands.

Related: Why You Should Think Twice Before Buying a Fixer-Upper Home

While 37 percent of homeowners had saved $5,000 or more for such emergencies, the survey found that 38 percent had less than $1,000 saved, and 23 percent had no money at all saved for unexpected repairs. “In the event of a home emergency, these homeowners can find themselves blindsided by the high cost of repairs and unable to take on the unexpected financial burden,” HomeServe USA’s CEO Tom Rusin said in a statement.

The results confirm the findings of a Federal Reserve study published last year, in which 46 percent of adults said they either wouldn’t be able to cover an unexpected $400 expense, or they’d have to sell something or borrow cash to pay the bill.

The HomeServe survey was conducted online by Harris Poll in August and included 2,027 adults ages 18 and older.