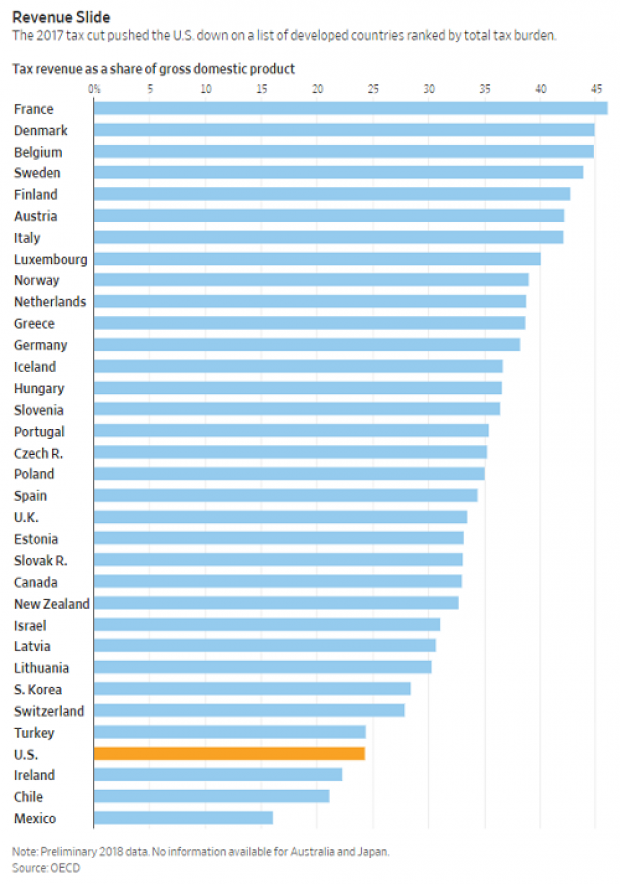

Total U.S. taxes as a share of the economy fell to 24.3% last year, thanks in large part to the tax cuts signed into law by President Trump in 2017, the Organization for Economic Cooperation and Development said Thursday in a new report.

The total U.S. tax burden fell 2.5 percentage points in 2018 compared to the year before, ranking the nation’s tax-to-GDP ratio near the bottom of the 36 OECD’s member nations. (The report is based on preliminary data from 34 countries, with no information available yet for Australia and Japan.)

U.S. tax levels are 10 percentage points below the OECD average, and about half those of France, which has the highest tax-to-GDP ratio at 46.1%. Twenty years ago, the U.S. was close to the middle of the pack, with a higher tax burden than Switzerland and South Korea. Now, only Ireland, Chile and Mexico have a lower tax burden.

It’s not just Trump: The latest reduction in the U.S. tax burden marks the culmination of a long-term effort on the right to slash taxes, including President George W. Bush’s tax cuts in 2001 and 2003, The Wall Street Journal’s Richard Rubin said Thursday. “The net effect of fiscal policy this century has been lower taxes and larger budget deficits,” Rubin noted.

Most OECD nations have had a different experience: Over the last 10 years, 26 OECD nations have seen their tax-to-GDP ratios increase, the report said. One reason for the discrepancy is the unusual tax and welfare systems in the U.S. "The U.S. fiscal system operates differently from those in much of the rest of the world,” the Journal’s Rubin wrote. “Other nations rely on value-added taxes to finance generous and universal social benefits, including health care and parental leave. ... The U.S. has no value-added tax and offers a less robust social-safety net."

Democratic tax plans would raise the tax ratio: If the Democratic presidential candidates agree on one thing, it’s that they all want to raise taxes. They disagree, however, on how to go about doing so, and how to spend the revenues the taxes would raise. Joe Biden proposes to raise $3.2 trillion over 10 years through relatively modest tax increases on corporations and the wealthy, while Elizabeth Warren wants to raise nearly 10 times that amount with much more aggressive tax hikes.

Jim Tankersley of The New York Times estimated the effect that the different Democratic tax plans would have on the country’s tax-to-GDP ratio. Biden’s plan would move the U.S. about one slot higher in the OECD ranking, Tankersley said. Warren’s plan, on the other hand, would “vault it above the OECD average, in the ballpark of Norway and the Netherlands,” he wrote Thursday, adding that such a move “would be a sea change in taxation for the US economy.”