Employers hired 150,000 new workers in October, the Labor Department announced Friday, marking a slowdown in the pace of hiring in the U.S. economy. Job gains in August and September were revised lower, as well, with the September reading moving down by 39,000 to a still robust 297,000.

The labor force decreased by 201,000 last month, and the unemployment rate rose slightly to 3.9% – low by historic standards, but the highest reading since January 2022.

Wage pressures also eased in October. Average hourly pay rose 0.2% on a monthly basis and 4.1% year over year – the lowest annual reading since June 2021.

What the experts are saying: Some analysts think the latest data is a signal that the long-expected economic slowdown has arrived. “October could be the turning point for the economy,” said Kathy Bostjancic, chief economist at Nationwide, per The Wall Street Journal. “We are seeing a cooling in labor demand and slow income growth which means we’re poised to see consumer spending slow quite dramatically.”

Still, it may be too soon to declare that the economy is on the verge of a recession. For one thing, the strike by autoworkers weighed on manufacturing employment last month, a temporary factor that will reverse next month. More broadly, the labor market may simply be returning to something like normal conditions following months of exceptionally high growth in the wake of the pandemic.

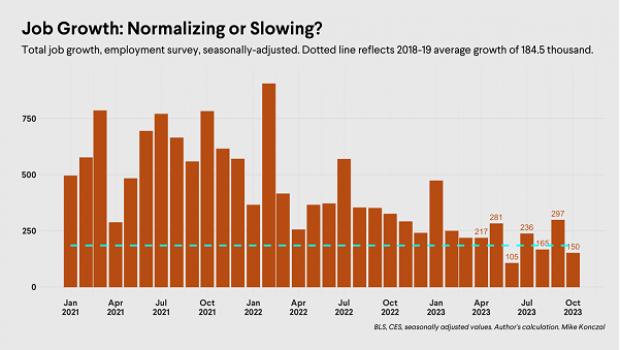

Economist Mike Konczal of the Roosevelt Institute, a left-leaning think tank, noted that the October hiring number isn’t far off the average level of hiring recorded in 2018 and 2019, before the pandemic warped the economy from top to bottom (see his chart below). “If you told me these numbers in a vacuum, only knowing unemployment has been below 4 percent for 22 months, I'd say they are great,” he wrote. At the same, Konzal said he was concerned that the decline in hiring in October may have been “too steep” given the Federal Reserve’s pledge to maintain high interest rates for an extended period of time.

Mark Zandi, chief economist at Moody’s Analytics, was more optimistic, saying the jobs report is just one of several signs pointing to the much-desired “soft landing” for the economy, in which inflation is brought under control without a recession. “Wow. What a great week for the economy,” he wrote. “The Oct jobs report was as good as it gets. Resilient, but moderating job growth, and easing wage pressures. And with oil prices back down to near $80/barrel, 10-yr T-yields close to 4.5%, and stocks showing lots of green, it’s tough not to think there will be a soft landing.”

Whether this is a turning point or just a smaller step along a gently sloped path, one thing seems more certain: The Fed is more likely to hold off on more rate hikes. “Put a fork in it – they are done,” said Jay Bryson, chief economist at Wells Fargo, per Bloomberg. “If you are an [Federal Open Market Committee] official, this is what you wanted to see. This is very good news for the Fed.”