Former President Donald Trump’s twin proposals to impose a 10% tariff on all imports and a 60% levy on imports from China would raise costs for a typical middle-income American household by $2,500 a year, according to an updated analysis from the Center for American Progress, a left-leaning think tank. An earlier analysis by the think tank had found that an across-the-board 10% tariff alone would amount to a $1,500 tax increase on a typical middle-class American family.

In their latest paper, authors Ryan Mulholland and Brendan Duke add that Trump’s tariff proposals “would create a one-time inflationary burst that could add up to 2.5 percentage points to the inflation rate according to Wall Street analysts.” And the revenue from the tariffs would be used to help finance Trump’s plan to extend his 2017 tax cuts, which the authors say “would cut taxes for the wealthy while raising taxes for everyone else.” The top 0.1% of Americans would see a net tax cut of $325,000, they write, while a middle-income family would get hit with a tax increase of $1,600, even after factoring in the renewed 2017 tax cuts.

“In other words,” the authors say, “Trump’s proposed tariffs would help offset the cost of his proposed tax cut extension by making middle- and working-class Americans pay more for groceries, gas, and clothes.”

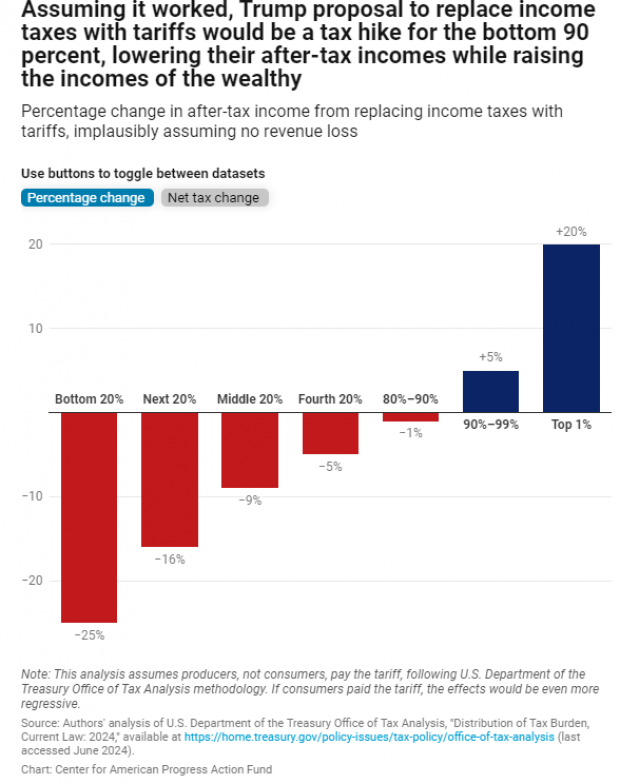

The authors also look at a proposal Trump reportedly floated to replace all income taxes with tariffs. The idea, which Trump apparently brought up last week in a meeting with Republican lawmakers, has been widely panned as unfeasible and, if attempted, incredibly expensive for low- and middle-income Americans. The Center for American Progress analysts call it “mathematically impossible” to replace the $2 trillion in annual revenue from individual income taxes with enough tariffs on the $3 trillion in goods imported every year. They add that, if it were doable, “it would dramatically increase income inequality and raise taxes for the bottom 90 percent of households. It would raise taxes for middle-income households by $5,100 to $8,300 while cutting taxes for the top 0.1 percent by at least $1.5 million annually.”