Take $3 trillion in unfunded legacy liabilities from state-sponsored pension plans, add $574 billion more from municipal and county pensions, and you have a fiscal tsunami that will make the Great Recession look like a cake walk.

In “The Crisis in Local Government Pensions in the United States,” a new report issued by the Kellogg School, economists Joshua Rauh of the Kellogg School and Robert Novy-Marx of the University of Rochester calculate the aggregate unfunded liabilities and forecast the number of years assets will last for 77 defined pension plans sponsored by 50 major U.S. cities and counties. The sample represented all non-state municipal entities with more than $1 billion in pension assets, covering 2.04 million local public employees and retirees.

“This new paper calculates the present value of local government employee pension liabilities for about two-thirds of total local government employees, and estimates the unfunded obligation for the remaining one-third of workers covered by municipal plans not in our sample,” said Rauh, associate professor of finance at the Kellogg School.

Chicago would need to allocate about eight years of

dedicated tax revenues to cover pension promises.

These unfunded promises will be a long-standing and substantial burden for American cities. For example, even if all other spending was shut down, the city of Chicago would need to allocate about eight years of dedicated tax revenues to cover pension promises.

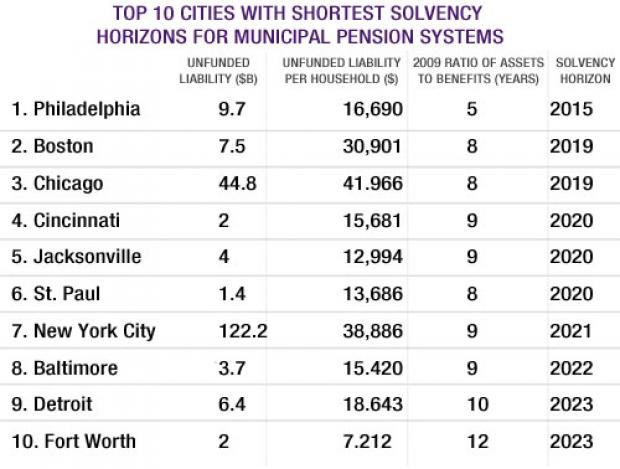

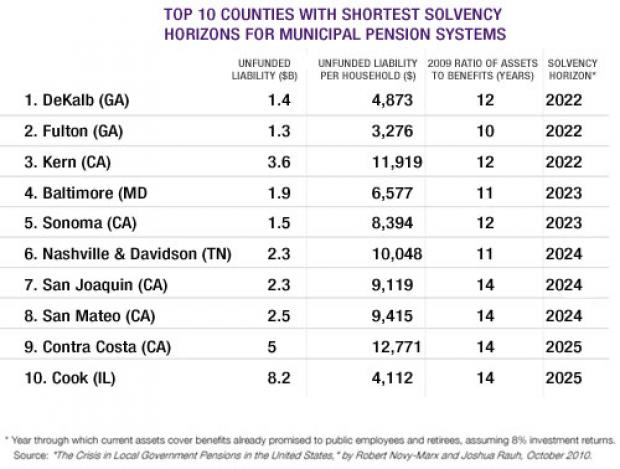

Six major cities have current pension assets that can only pay for promised benefits through 2020: Philadelphia, Boston, Chicago, Cincinnati, Jacksonville and St. Paul. An additional 18 cities and counties, including New York City, Detroit, Cook County in Illinois and Orange County in California would be solvent through 2020 but not past 2025.

“Philadelphia has the most immediate cause for concern, as the city can pay existing promises with existing assets only through 2015 — less than five years from now,” Rauh said.

cuts, [taxpayers] also will be called upon to pay for their

share of the $3 trillion unfunded liabilities at the state level.”

Rauh and Novy-Marx estimate that each household already owes an average of $14,165 to current and former municipal public employees in the 50 cities and counties they studied, including only the unfunded portion of benefits that have already been promised based on work performed. In New York City, San Francisco, and Boston, the total is more than $30,000 per household. In Chicago, the total is more than $40,000 per household.

“The situation is especially dire for taxpayers in these areas,” Rauh said. “In addition to being exposed to the prospect of severe local government tax increases and spending cuts, they also will be called upon to pay for their share of the $3 trillion unfunded liabilities at the state level.”

According to Rauh, it is clear that state and local governments in the U.S. are not far from the point where these pension promises will impact their ability to operate. Once the funds themselves are liquidated, the extent to which promised pension payments are competing with other local resources will skyrocket, eroding a large portion of many municipal budgets.

Bonds on the Brink

“The fact that there is such a large burden of public employee pensions concentrated in urban metropolitan areas threatens the long-run economic viability of these cities, as residents can potentially move elsewhere to escape the situation,” he explained.

“What is yet to be seen is how this burden will be distributed between state and local governments, and whether the federal government will be called upon for bailouts. If these issues are left unresolved, fiscal crises on the state and local levels may translate into significant losses for municipal bondholders,” he concluded.